Page 118 - CityofSouthlakeFY26AdoptedBudget

P. 118

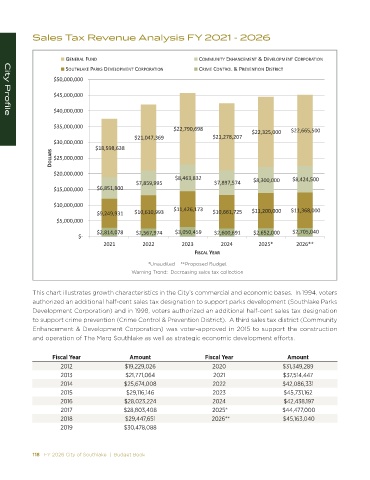

Sales Tax Revenue Analysis FY 2021 - 2026

' E Z > &hE KDDhE/dz E, E D Ed Θ s >KWD Ed KZWKZ d/KE

^Khd,> < W Z<^ s >KWD Ed KZWKZ d/KE Z/D KEdZK> Θ WZ s Ed/KE /^dZ/ d

ΨϱϬ͕ϬϬϬ͕ϬϬϬ

Ψϰϱ͕ϬϬϬ͕ϬϬϬ

ΨϰϬ͕ϬϬϬ͕ϬϬϬ

City Profile

Ψϯϱ͕ϬϬϬ͕ϬϬϬ ΨϮϮ͕ϳϵϬ͕ϲϵϴ ΨϮϮ͕ϯϮϱ͕ϬϬϬ ΨϮϮ͕ϲϲϱ͕ϱϬϬ

ΨϮϭ͕Ϭϰϳ͕ϯϲϵ ΨϮϭ͕Ϯϳϴ͕ϮϬϳ

ΨϯϬ͕ϬϬϬ͕ϬϬϬ

Ψϭϴ͕ϱϵϴ͕ϲϯϴ

K>> Z^ ΨϮϱ͕ϬϬϬ͕ϬϬϬ

ΨϮϬ͕ϬϬϬ͕ϬϬϬ Ψϴ͕ϰϲϯ͕ϴϯϮ

Ψϳ͕ϴϱϵ͕ϵϵϱ Ψϳ͕ϴϵϳ͕ϱϳϰ Ψϴ͕ϯϬϬ͕ϬϬϬ Ψϴ͕ϰϮϰ͕ϱϬϬ

Ψϭϱ͕ϬϬϬ͕ϬϬϬ Ψϲ͕ϴϱϭ͕ϴϬϬ

ΨϭϬ͕ϬϬϬ͕ϬϬϬ Ψϭϭ͕ϰϮϲ͕ϭϳϯ

Ψϵ͕Ϯϰϵ͕ϵϯϭ ΨϭϬ͕ϲϭϬ͕ϵϵϯ ΨϭϬ͕ϲϲϭ͕ϳϮϱ Ψϭϭ͕ϮϬϬ͕ϬϬϬ Ψϭϭ͕ϯϲϴ͕ϬϬϬ

Ψϱ͕ϬϬϬ͕ϬϬϬ

ΨϮ͕ϴϭϰ͕Ϭϳϴ ΨϮ͕ϱϲϳ͕ϵϳϰ Ψϯ͕ϬϱϬ͕ϰϱϵ ΨϮ͕ϲϬϬ͕ϲϵϭ ΨϮ͕ϲϱϮ͕ϬϬϬ ΨϮ͕ϳϬϱ͕ϬϰϬ

ΨͲ

ϮϬϮϭ ϮϬϮϮ ϮϬϮϯ ϮϬϮϰ ϮϬϮϱΎ ϮϬϮϲΎΎ

&/^ > z Z

*Unaudited **Proposed Budget

Warning Trend: Decreasing sales tax collection

This chart illustrates growth characteristics in the City’s commercial and economic bases. In 1994, voters

authorized an additional half-cent sales tax designation to support parks development (Southlake Parks

Development Corporation) and in 1998, voters authorized an additional half-cent sales tax designation

to support crime prevention (Crime Control & Prevention District). A third sales tax district (Community

Enhancement & Development Corporation) was voter-approved in 2015 to support the construction

and operation of The Marq Southlake as well as strategic economic development efforts.

Fiscal Year Amount Fiscal Year Amount

2012 $19,229,026 2020 $31,349,289

2013 $21,771,064 2021 $37,514,447

2014 $25,674,008 2022 $42,086,331

2015 $29,116,146 2023 $45,731,162

2016 $28,023,224 2024 $42,438,197

2017 $28,803,408 2025* $44,477,000

2018 $29,447,651 2026** $45,163,040

2019 $30,478,088

118 FY 2026 City of Southlake | Budget Book FY 2026 City of Southlake | Budget Book 119