Page 33 - Southlake FY22 Budget

P. 33

TrAnSMITTAL LETTEr

COmmuniTy enhanCemenT and

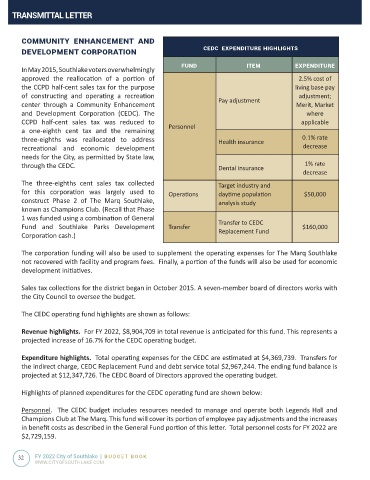

develOPmenT COrPOraTiOn CedC exPendiTure highlighTs

fund iTem exPendiTure

In May 2015, Southlake voters overwhelmingly

approved the reallocation of a portion of 2.5% cost of

the CCPD half-cent sales tax for the purpose living base pay

of constructing and operating a recreation adjustment;

center through a Community Enhancement Pay adjustment Merit, Market

and Development Corporation (CEDC). The where

CCPD half-cent sales tax was reduced to Personnel applicable

a one-eighth cent tax and the remaining

three-eighths was reallocated to address Health insurance 0.1% rate

recreational and economic development decrease

needs for the City, as permitted by State law,

through the CEDC. Dental insurance 1% rate

decrease

The three-eighths cent sales tax collected Target industry and

for this corporation was largely used to Operations daytime population $50,000

construct Phase 2 of The Marq Southlake, analysis study

known as Champions Club. (Recall that Phase

1 was funded using a combination of General

Fund and Southlake Parks Development Transfer Transfer to CEDC $160,000

Corporation cash.) Replacement Fund

The corporation funding will also be used to supplement the operating expenses for The Marq Southlake

not recovered with facility and program fees. Finally, a portion of the funds will also be used for economic

development initiatives.

Sales tax collections for the district began in October 2015. A seven-member board of directors works with

the City Council to oversee the budget.

The CEDC operating fund highlights are shown as follows:

Revenue highlights. For FY 2022, $8,904,709 in total revenue is anticipated for this fund. This represents a

projected increase of 16.7% for the CEDC operating budget.

Expenditure highlights. Total operating expenses for the CEDC are estimated at $4,369,739. Transfers for

the indirect charge, CEDC Replacement Fund and debt service total $2,967,244. The ending fund balance is

projected at $12,347,726. The CEDC Board of Directors approved the operating budget.

Highlights of planned expenditures for the CEDC operating fund are shown below:

Personnel. The CEDC budget includes resources needed to manage and operate both Legends Hall and

Champions Club at The Marq. This fund will cover its portion of employee pay adjustments and the increases

in benefit costs as described in the General Fund portion of this letter. Total personnel costs for FY 2022 are

$2,729,159.

32 FY 2022 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM