Page 37 - Southlake FY22 Budget

P. 37

TrAnSMITTAL LETTEr

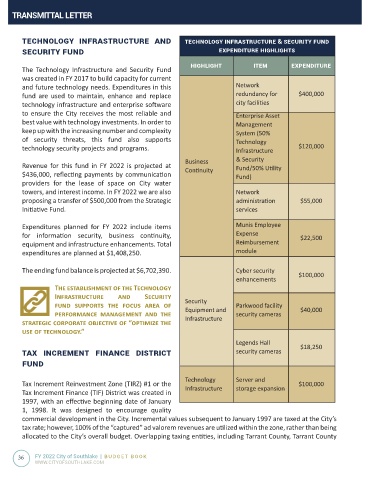

TeChnOlOgy infrasTruCTure and TeChnOlOgy infrasTruCTure & seCuriTy fund

seCuriTy fund exPendiTure highlighTs

highlighT iTem exPendiTure

The Technology Infrastructure and Security Fund

was created in FY 2017 to build capacity for current

and future technology needs. Expenditures in this Network

fund are used to maintain, enhance and replace redundancy for $400,000

technology infrastructure and enterprise software city facilities

to ensure the City receives the most reliable and Enterprise Asset

best value with technology investments. In order to Management

keep up with the increasing number and complexity System (50%

of security threats, this fund also supports Technology

technology security projects and programs. Infrastructure $120,000

Business & Security

Revenue for this fund in FY 2022 is projected at Continuity Fund/50% Utility

$436,000, reflecting payments by communication Fund)

providers for the lease of space on City water

towers, and interest income. In FY 2022 we are also Network

proposing a transfer of $500,000 from the Strategic administration $55,000

Initiative Fund. services

Expenditures planned for FY 2022 include items Munis Employee

for information security, business continuity, Expense $22,500

equipment and infrastructure enhancements. Total Reimbursement

expenditures are planned at $1,408,250. module

The ending fund balance is projected at $6,702,390. Cyber security

enhancements $100,000

The establishment of the Technology

Infrastructure and Security Security

fund supports the focus area of Parkwood facility

performance management and the Equipment and security cameras $40,000

strategic corporate objective of “optimize the Infrastructure

use of technology.”

Legends Hall $18,250

Tax inCremenT finanCe disTriCT security cameras

fund

Technology Server and

Tax Increment Reinvestment Zone (TIRZ) #1 or the Infrastructure storage expansion $100,000

Tax Increment Finance (TIF) District was created in

1997, with an effective beginning date of January

1, 1998. It was designed to encourage quality

commercial development in the City. Incremental values subsequent to January 1997 are taxed at the City’s

tax rate; however, 100% of the “captured” ad valorem revenues are utilized within the zone, rather than being

allocated to the City’s overall budget. Overlapping taxing entities, including Tarrant County, Tarrant County

36 FY 2022 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM