Page 39 - Southlake FY22 Budget

P. 39

TrAnSMITTAL LETTEr

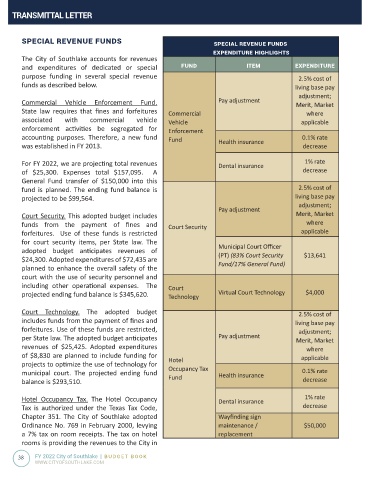

sPeCial revenue funds sPeCial revenue funds

exPendiTure highlighTs

The City of Southlake accounts for revenues

and expenditures of dedicated or special fund iTem exPendiTure

purpose funding in several special revenue 2.5% cost of

funds as described below. living base pay

adjustment;

Commercial Vehicle Enforcement Fund. Pay adjustment Merit, Market

State law requires that fines and forfeitures Commercial where

associated with commercial vehicle Vehicle applicable

enforcement activities be segregated for Enforcement

accounting purposes. Therefore, a new fund Fund 0.1% rate

was established in FY 2013. Health insurance decrease

For FY 2022, we are projecting total revenues Dental insurance 1% rate

of $25,300. Expenses total $157,095. A decrease

General Fund transfer of $150,000 into this

fund is planned. The ending fund balance is 2.5% cost of

projected to be $99,564. living base pay

adjustment;

Pay adjustment

Court Security. This adopted budget includes Merit, Market

funds from the payment of fines and Court Security where

forfeitures. Use of these funds is restricted applicable

for court security items, per State law. The Municipal Court Officer

adopted budget anticipates revenues of

$24,300. Adopted expenditures of $72,435 are (PT) (83% Court Security $13,641

planned to enhance the overall safety of the Fund/17% General Fund)

court with the use of security personnel and

including other operational expenses. The Court

projected ending fund balance is $345,620. Technology Virtual Court Technology $4,000

Court Technology. The adopted budget 2.5% cost of

includes funds from the payment of fines and living base pay

forfeitures. Use of these funds are restricted, adjustment;

per State law. The adopted budget anticipates Pay adjustment Merit, Market

revenues of $25,425. Adopted expenditures where

of $8,830 are planned to include funding for applicable

projects to optimize the use of technology for Hotel

municipal court. The projected ending fund Occupancy Tax Health insurance 0.1% rate

Fund

balance is $293,510. decrease

Hotel Occupancy Tax. The Hotel Occupancy Dental insurance 1% rate

Tax is authorized under the Texas Tax Code, decrease

Chapter 351. The City of Southlake adopted Wayfinding sign

Ordinance No. 769 in February 2000, levying maintenance / $50,000

a 7% tax on room receipts. The tax on hotel replacement

rooms is providing the revenues to the City in

38 FY 2022 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM