Page 185 - Hurst Adopted FY22 Budget

P. 185

APPROVED FISCAL YEAR 2022 BUDGET

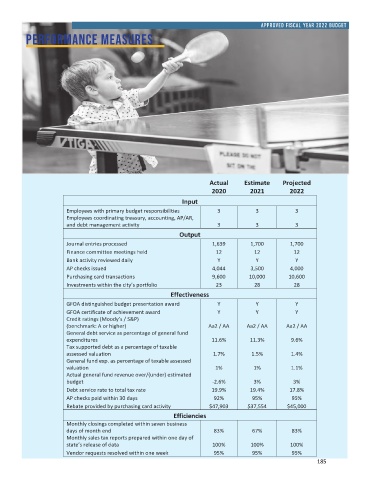

performance measures

Actual Estimate Projected

2020 2021 2022

Input

Employees with primary budget responsibilities 3 3 3

Employees coordinating treasury, accounting, AP/AR,

and debt management activity 3 3 3

Output

Journal entries processed 1,639 1,700 1,700

Finance committee meetings held 12 12 12

Bank activity reviewed daily Y Y Y

AP checks issued 4,044 3,500 4,000

Purchasing card transactions 9,600 10,000 10,600

Investments within the city’s portfolio 23 28 28

Effectiveness

GFOA distinguished budget presentation award Y Y Y

GFOA certificate of achievement award Y Y Y

Credit ratings (Moody’s / S&P)

(benchmark: A or higher) Aa2 / AA Aa2 / AA Aa2 / AA

General debt service as percentage of general fund

expenditures 11.6% 11.3% 9.6%

Tax supported debt as a percentage of taxable

assessed valuation 1.7% 1.5% 1.4%

General fund exp. as percentage of taxable assessed

valuation 1% 1% 1.1%

Actual general fund revenue over/(under) estimated

budget -2.6% 3% 3%

Debt service rate to total tax rate 19.9% 19.4% 17.8%

AP checks paid within 30 days 92% 95% 95%

Rebate provided by purchasing card activity $47,903 $37,554 $45,000

Efficiencies

Monthly closings completed within seven business

days of month end 83% 67% 83%

Monthly sales tax reports prepared within one day of

state’s release of data 100% 100% 100%

Vendor requests resolved within one week 95% 95% 95%

185