Page 92 - Southlake FY20 Budget

P. 92

City Profile

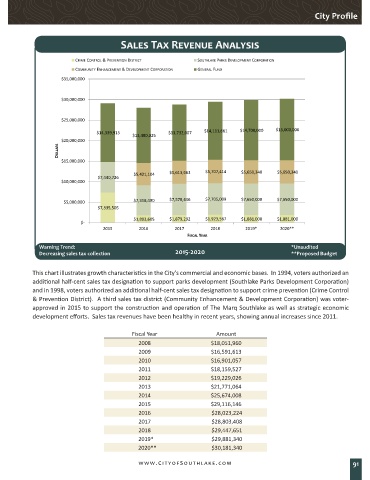

Sales Tax Revenue Analysis

CRIME CONTROL & PREVENTION DISTRICT SOUTHLAKE PARKS DEVELOPMENT CORPORATION

COMMUNITY ENHANCEMENT & DEVELOPMENT CORPORATION GENERAL FUND

$35,000,000

$30,000,000

$25,000,000

$14,339,915 $13,732,007 $14,111,661 $14,700,000 $15,000,000

$13,480,025

$20,000,000

DOLLARS

$15,000,000

$5,421,104 $5,613,663 $5,707,414 $5,650,340 $5,650,340

$7,440,726

$10,000,000

$5,000,000 $7,318,490 $7,578,446 $7,705,009 $7,650,000 $7,650,000

$7,335,505

$1,803,605 $1,879,292 $1,923,567 $1,881,000 $1,881,000

$-

2015 2016 2017 2018 2019* 2020**

FISCAL YEAR

Warning Trend: *Unaudited

Decreasing sales tax collection 2015-2020 **Proposed Budget

This chart illustrates growth characteristics in the City’s commercial and economic bases. In 1994, voters authorized an

additional half-cent sales tax designation to support parks development (Southlake Parks Development Corporation)

and in 1998, voters authorized an additional half-cent sales tax designation to support crime prevention (Crime Control

& Prevention District). A third sales tax district (Community Enhancement & Development Corporation) was voter-

approved in 2015 to support the construction and operation of The Marq Southlake as well as strategic economic

development efforts. Sales tax revenues have been healthy in recent years, showing annual increases since 2011.

Fiscal Year Amount

2008 $18,051,960

2009 $16,591,613

2010 $16,901,057

2011 $18,159,527

2012 $19,229,026

2013 $21,771,064

2014 $25,674,008

2015 $29,116,146

2016 $28,023,224

2017 $28,803,408

2018 $29,447,651

2019* $29,881,340

2020** $30,181,340

www.CityofSouthlake.com 91