Page 105 - CityofSouthlakeFY26AdoptedBudget

P. 105

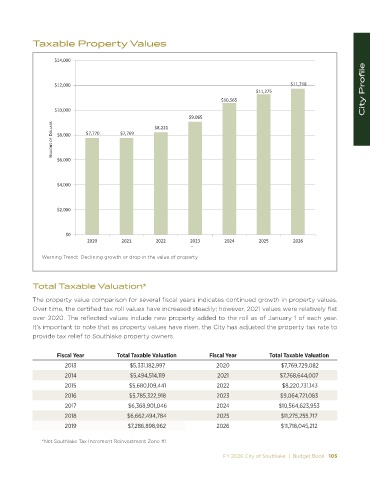

Taxable Property Values

Ψϭϰ͕ϬϬϬ

City Profile

ΨϭϮ͕ϬϬϬ Ψϭϭ͕ϳϭϴ

Ψϭϭ͕Ϯϳϱ

ΨϭϬ͕ϱϲϱ

ΨϭϬ͕ϬϬϬ

Ψϵ͕Ϭϲϱ

/>>/KE^ K& K>> Z^ Ψϴ͕ϬϬϬ Ψϳ͕ϳϳϬ Ψϳ͕ϳϲϵ

Ψϴ͕ϮϮϭ

Ψϲ͕ϬϬϬ

Ψϰ͕ϬϬϬ

ΨϮ͕ϬϬϬ

ΨϬ

ϮϬϮϬ ϮϬϮϭ ϮϬϮϮ ϮϬϮϯ ϮϬϮϰ ϮϬϮϱ ϮϬϮϲ

z Z

Warning Trend: Declining growth or drop in the value of property

Total Taxable Valuation*

The property value comparison for several fiscal years indicates continued growth in property values.

Over time, the certified tax roll values have increased steadily; however, 2021 values were relatively flat

over 2020. The reflected values include new property added to the roll as of January 1 of each year.

It’s important to note that as property values have risen, the City has adjusted the property tax rate to

provide tax relief to Southlake property owners.

Fiscal Year Total Taxable Valuation Fiscal Year Total Taxable Valuation

2013 $5,331,182,997 2020 $7,769,729,082

2014 $5,494,514,119 2021 $7,768,644,007

2015 $5,680,109,441 2022 $8,220,731,143

2016 $5,785,322,918 2023 $9,064,721,083

2017 $6,368,901,046 2024 $10,564,623,953

2018 $6,662,494,784 2025 $11,275,255,717

2019 $7,286,898,962 2026 $11,718,045,212

*Net Southlake Tax Increment Reinvestment Zone #1

FY 2026 City of Southlake | Budget Book 105