Page 79 - City of Fort Worth Budget Book

P. 79

Budget Highlights Revenue Highlights

Net Taxable Value (Certified) $ 117,353,239,390

Plus

Est. Minimum value of protest properties $ 2,565,974,257

Est. Minimum Taxable Value of Incomplete Properties $ 1,997,965,893

Adjusted Net Taxable Value $ 121,923,036,056

Tax Rate per $100 of Value $ 0.67730

Total Tax Levy $ 825,784,723

Less

Collection Rate 98.5 %

Estimated Collection of Levy $ 813,397,952

Less

Less Levy Lost due to Frozen $ (9,388,454)

Less Estimated TIF Contribution $ (20,777,519)

Budgeted Revenues $ 783,231,979

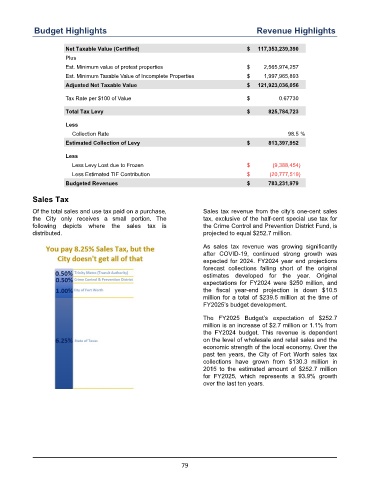

Sales Tax

Of the total sales and use tax paid on a purchase, Sales tax revenue from the city’s one-cent sales

the City only receives a small portion. The tax, exclusive of the half-cent special use tax for

following depicts where the sales tax is the Crime Control and Prevention District Fund, is

distributed. projected to equal $252.7 million.

As sales tax revenue was growing significantly

after COVID-19, continued strong growth was

expected for 2024. FY2024 year end projections

forecast collections falling short of the original

estimates developed for the year. Original

expectations for FY2024 were $250 million, and

the fiscal year-end projection is down $10.5

million for a total of $239.5 million at the time of

FY2025’s budget development.

The FY2025 Budget’s expectation of $252.7

million is an increase of $2.7 million or 1.1% from

the FY2024 budget. This revenue is dependent

on the level of wholesale and retail sales and the

economic strength of the local economy. Over the

past ten years, the City of Fort Worth sales tax

collections have grown from $130.3 million in

2015 to the estimated amount of $252.7 million

for FY2025, which represents a 93.9% growth

over the last ten years.

79