Page 78 - City of Fort Worth Budget Book

P. 78

Budget Highlights Revenue Highlights

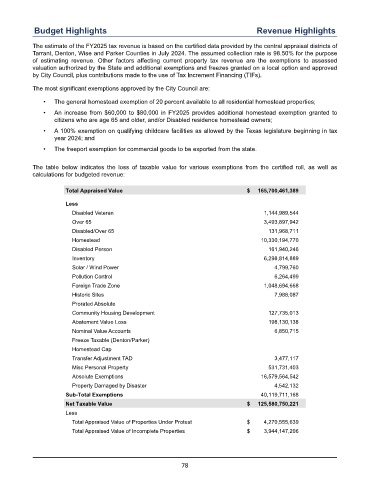

The estimate of the FY2025 tax revenue is based on the certified data provided by the central appraisal districts of

Tarrant, Denton, Wise and Parker Counties in July 2024. The assumed collection rate is 98.50% for the purpose

of estimating revenue. Other factors affecting current property tax revenue are the exemptions to assessed

valuation authorized by the State and additional exemptions and freezes granted on a local option and approved

by City Council, plus contributions made to the use of Tax Increment Financing (TIFs).

The most significant exemptions approved by the City Council are:

• The general homestead exemption of 20 percent available to all residential homestead properties;

• An increase from $60,000 to $80,000 in FY2025 provides additional homestead exemption granted to

citizens who are age 65 and older, and/or Disabled residence homestead owners;

• A 100% exemption on qualifying childcare facilities as allowed by the Texas legislature beginning in tax

year 2024; and

• The freeport exemption for commercial goods to be exported from the state.

The table below indicates the loss of taxable value for various exemptions from the certified roll, as well as

calculations for budgeted revenue:

Total Appraised Value $ 165,700,461,389

Less

Disabled Veteran 1,144,989,544

Over 65 3,493,897,942

Disabled/Over 65 131,968,711

Homestead 10,330,194,770

Disabled Person 161,940,246

Inventory 6,298,814,889

Solar / Wind Power 4,799,760

Pollution Control 6,264,499

Foreign Trade Zone 1,048,694,668

Historic Sites 7,988,087

Prorated Absolute

Community Housing Development 127,735,013

Abatement Value Loss 198,130,138

Nominal Value Accounts 6,850,715

Freeze Taxable (Denton/Parker)

Homestead Cap

Transfer Adjustment TAD 3,477,117

Misc Personal Property 531,731,403

Absolute Exemptions 16,579,564,542

Property Damaged by Disaster 4,542,132

Sub-Total Exemptions 40,119,711,168

Net Taxable Value $ 125,580,750,221

Less

Total Appraised Value of Properties Under Protest $ 4,270,555,639

Total Appraised Value of Incomplete Properties $ 3,944,147,206

78