Page 76 - City of Fort Worth Budget Book

P. 76

Budget Highlights Revenue Highlights

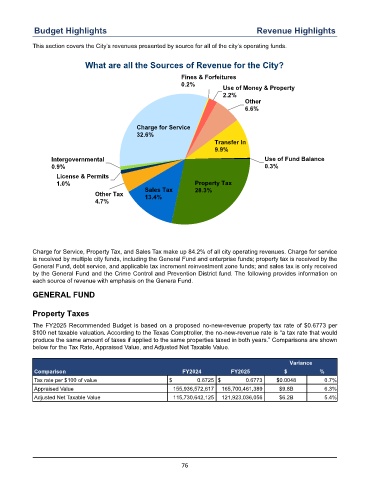

This section covers the City’s revenues presented by source for all of the city’s operating funds.

What are all the Sources of Revenue for the City?

Fines & Forfeitures

0.2%

Use of Money & Property

2.2%

Other

6.6%

Charge for Service

32.6%

Transfer In

9.9%

Intergovernmental Use of Fund Balance

0.9% 0.3%

License & Permits

1.0% Property Tax

Sales Tax 28.3%

Other Tax 13.4%

4.7%

Charge for Service, Property Tax, and Sales Tax make up 84.2% of all city operating revenues. Charge for service

is received by multiple city funds, including the General Fund and enterprise funds; property tax is received by the

General Fund, debt service, and applicable tax increment reinvestment zone funds; and sales tax is only received

by the General Fund and the Crime Control and Prevention District fund. The following provides information on

each source of revenue with emphasis on the Genera Fund.

GENERAL FUND

Property Taxes

The FY2025 Recommended Budget is based on a proposed no-new-revenue property tax rate of $0.6773 per

$100 net taxable valuation. According to the Texas Comptroller, the no-new-revenue rate is “a tax rate that would

produce the same amount of taxes if applied to the same properties taxed in both years.” Comparisons are shown

below for the Tax Rate, Appraised Value, and Adjusted Net Taxable Value.

Variance

Comparison FY2024 FY2025 $ %

Tax rate per $100 of value $ 0.6725 $ 0.6773 $0.0048 0.7 %

Appraised Value 155,936,572,617 165,700,461,389 $9.8B 6.3 %

Adjusted Net Taxable Value 115,730,642,125 121,923,036,056 $6.2B 5.4 %

76