Page 122 - CityofWataugaAdoptedBudgetFY24

P. 122

BUDGET SUMMARY

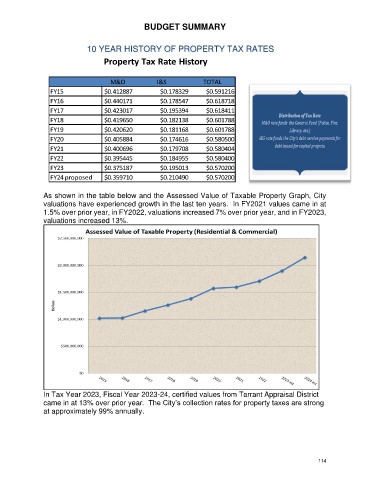

10 YEAR HISTORY OF PROPERTY TAX RATES

Property Tax Rate History

M&O I&S TOTAL

FY15 $0.412887 $0.178329 $0.591216

FY16 $0.440171 $0.178547 $0.618718

FY17 $0.423017 $0.195394 $0.618411

FY18 $0.419650 $0.182138 $0.601788

FY19 $0.420620 $0.181168 $0.601788

FY20 $0.405884 $0.174616 $0.580500

FY21 $0.400696 $0.179708 $0.580404

FY22 $0.395445 $0.184955 $0.580400

FY23 $0.375187 $0.195013 $0.570200

FY24 proposed $0.359710 $0.210490 $0.570200

As shown in the table below and the Assessed Value of Taxable Property Graph, City

valuations have experienced growth in the last ten years. In FY2021 values came in at

1.5% over prior year, in FY2022, valuations increased 7% over prior year, and in FY2023,

valuations increased 13%.

In Tax Year 2023, Fiscal Year 2023-24, certified values from Tarrant Appraisal District

came in at 13% over prior year. The City’s collection rates for property taxes are strong

at approximately 99% annually.

114