Page 121 - CityofWataugaAdoptedBudgetFY24

P. 121

BUDGET SUMMARY

➢ In FY2023-2024, valuations increased by 13%, compared to an increase of 11%

in FY2022-2023. In the FY2023-2024 budget, the tax rate of $0.57020 per 100

of valuation maintains the current tax rate and includes an unused increment rate

of $.014 to bring in additional revenue to cover cost increases and the restoring

of positions. The tax rate is a result of the higher valuations and will ensure that

the quality service levels and programs are maintained, and new debt service

requirements are met for capital projects in the City.

➢ The tax rate for FY2023-2024 is $0.5702/$100 of valuation. The tax rate

distribution for FY2023-2024 compared to FY2022-2023 is as follows:

FY2023-24 FY2022-23

Maintenance and Operations: $0.359710/$100 $0.375187/$100

Interest & Sinking $0.210490/$100 $0.195013/$100

TOTAL TAX RATE: $0.57020/$100 $0.570200/$100

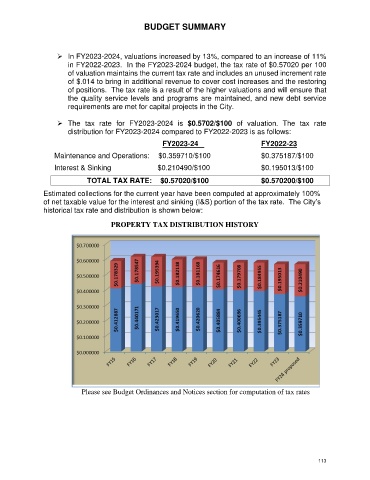

Estimated collections for the current year have been computed at approximately 100%

of net taxable value for the interest and sinking (I&S) portion of the tax rate. The City’s

historical tax rate and distribution is shown below:

PROPERTY TAX DISTRIBUTION HISTORY

Please see Budget Ordinances and Notices section for computation of tax rates

113