Page 36 - Southlake FY23 Budget

P. 36

TRAnSmITTAL LETTER

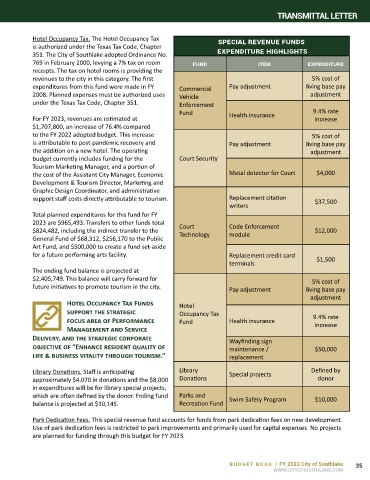

Hotel Occupancy Tax. The Hotel Occupancy Tax speciAl reVenue Funds

is authorized under the Texas Tax Code, Chapter

351. The City of Southlake adopted Ordinance No. expenditure highlights

769 in February 2000, levying a 7% tax on room Fund item expenditure

receipts. The tax on hotel rooms is providing the

revenues to the city in this category. The first 5% cost of

expenditures from this fund were made in FY Commercial Pay adjustment living base pay

2008. Planned expenses must be authorized uses Vehicle adjustment

under the Texas Tax Code, Chapter 351. Enforcement

Fund Health insurance 9.4% rate

For FY 2023, revenues are estimated at increase

$1,707,800, an increase of 76.4% compared

to the FY 2022 adopted budget. This increase 5% cost of

is attributable to post-pandemic recovery and Pay adjustment living base pay

the addition on a new hotel. The operating adjustment

budget currently includes funding for the Court Security

Tourism Marketing Manager, and a portion of

the cost of the Assistant City Manager, Economic Metal detector for Court $4,000

Development & Tourism Director, Marketing and

Graphic Design Coordinator, and administrative

support staff costs directly attributable to tourism. Replacement citation $37,500

writers

Total planned expenditures for this fund for FY

2023 are $965,493. Transfers to other funds total Court Code Enforcement

$824,482, including the indirect transfer to the Technology module $12,000

General Fund of $68,312, $256,170 to the Public

Art Fund, and $500,000 to create a fund set-aside

for a future performing arts facility. Replacement credit card

terminals $1,500

The ending fund balance is projected at

$2,405,749. This balance will carry forward for 5% cost of

future initiatives to promote tourism in the city. Pay adjustment living base pay

adjustment

Hotel Occupancy Tax Funds Hotel

support the strategic Occupancy Tax

focus area of Performance Fund Health insurance 9.4% rate

Management and Service increase

Delivery, and the strategic corporate Wayfinding sign

objective of “Enhance resident quality of maintenance / $50,000

life & business vitality through tourism.” replacement

Library Donations. Staff is anticipating Library Special projects Defined by

approximately $4,070 in donations and the $8,000 Donations donor

in expenditures will be for library special projects,

which are often defined by the donor. Ending fund Parks and Swim Safety Program $10,000

balance is projected at $10,145. Recreation Fund

Park Dedication Fees. This special revenue fund accounts for funds from park dedication fees on new development.

Use of park dedication fees is restricted to park improvements and primarily used for capital expenses. No projects

are planned for funding through this budget for FY 2023.

BUDGET BOOK | FY 2023 City of Southlake 35

WWW.CITYOFSOUTHLAKE.COM