Page 35 - Southlake FY23 Budget

P. 35

TRAnSmITTAL LETTER

tax dollars are restricted and may only be used for

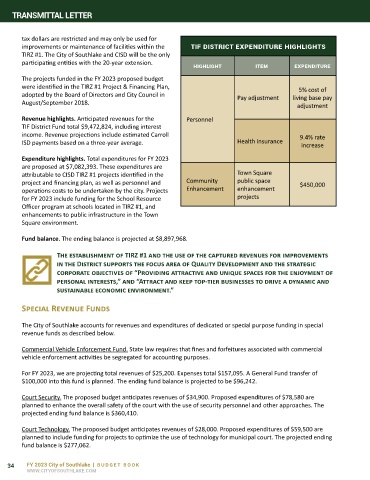

improvements or maintenance of facilities within the tiF district expenditure highlights

TIRZ #1. The City of Southlake and CISD will be the only

participating entities with the 20-year extension. highlight item expenditure

The projects funded in the FY 2023 proposed budget

were identified in the TIRZ #1 Project & Financing Plan, 5% cost of

adopted by the Board of Directors and City Council in Pay adjustment living base pay

August/September 2018. adjustment

Revenue highlights. Anticipated revenues for the Personnel

TIF District Fund total $9,472,824, including interest

income. Revenue projections include estimated Carroll 9.4% rate

ISD payments based on a three-year average. Health insurance increase

Expenditure highlights. Total expenditures for FY 2023

are proposed at $7,082,393. These expenditures are

attributable to CISD TIRZ #1 projects identified in the Town Square

project and financing plan, as well as personnel and Community public space $450,000

operations costs to be undertaken by the city. Projects Enhancement enhancement

for FY 2023 include funding for the School Resource projects

Officer program at schools located in TIRZ #1, and

enhancements to public infrastructure in the Town

Square environment.

Fund balance. The ending balance is projected at $8,897,968.

The establishment of TIRZ #1 and the use of the captured revenues for improvements

in the District supports the focus area of Quality Development and the strategic

corporate objectives of “Providing attractive and unique spaces for the enjoyment of

personal interests,” and “Attract and keep top-tier businesses to drive a dynamic and

sustainable economic environment.”

Special Revenue Funds

The City of Southlake accounts for revenues and expenditures of dedicated or special purpose funding in special

revenue funds as described below.

Commercial Vehicle Enforcement Fund. State law requires that fines and forfeitures associated with commercial

vehicle enforcement activities be segregated for accounting purposes.

For FY 2023, we are projecting total revenues of $25,200. Expenses total $157,095. A General Fund transfer of

$100,000 into this fund is planned. The ending fund balance is projected to be $96,242.

Court Security. The proposed budget anticipates revenues of $34,900. Proposed expenditures of $78,580 are

planned to enhance the overall safety of the court with the use of security personnel and other approaches. The

projected ending fund balance is $360,410.

Court Technology. The proposed budget anticipates revenues of $28,000. Proposed expenditures of $59,500 are

planned to include funding for projects to optimize the use of technology for municipal court. The projected ending

fund balance is $277,062.

34 FY 2023 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM