Page 22 - Southlake FY23 Budget

P. 22

TRAnSmITTAL LETTER

from commercial permits is expected to

decline when compared to the adopted FY tAx rAte compArison

2022 budget.

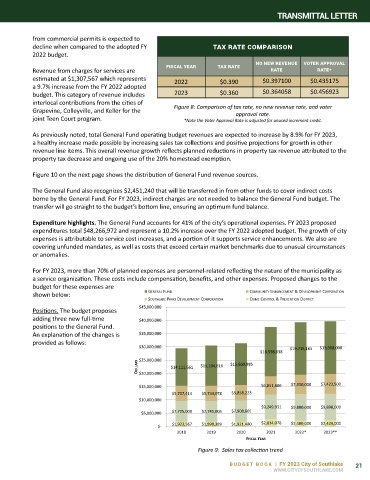

no new reVenue Voter ApproVAl

FiscAl YeAr tAx rAte

Revenue from charges for services are rAte rAte*

estimated at $1,307,567 which represents 2022 $0.390 $0.397100 $0.435175

a 9.7% increase from the FY 2022 adopted

budget. This category of revenue includes 2023 $0.360 $0.364058 $0.456923

interlocal contributions from the cities of

Grapevine, Colleyville, and Keller for the Figure 8: Comparison of tax rate, no new revenue rate, and voter

approval rate.

joint Teen Court program. *Note the Voter Approval Rate is adjusted for unused increment credit.

As previously noted, total General Fund operating budget revenues are expected to increase by 8.9% for FY 2023,

a healthy increase made possible by increasing sales tax collections and positive projections for growth in other

revenue line items. This overall revenue growth reflects planned reductions in property tax revenue attributed to the

property tax decrease and ongoing use of the 20% homestead exemption.

Figure 10 on the next page shows the distribution of General Fund revenue sources.

The General Fund also recognizes $2,451,240 that will be transferred in from other funds to cover indirect costs

borne by the General Fund. For FY 2023, indirect charges are not needed to balance the General Fund budget. The

transfer will go straight to the budget’s bottom line, ensuring an optimum fund balance.

Expenditure highlights. The General Fund accounts for 41% of the city’s operational expenses. FY 2023 proposed

expenditures total $48,266,972 and represent a 10.2% increase over the FY 2022 adopted budget. The growth of city

expenses is attributable to service cost increases, and a portion of it supports service enhancements. We also are

covering unfunded mandates, as well as costs that exceed certain market benchmarks due to unusual circumstances

or anomalies.

For FY 2023, more than 70% of planned expenses are personnel-related reflecting the nature of the municipality as

a service organization. These costs include compensation, benefits, and other expenses. Proposed changes to the

budget for these expenses are

shown below: GENERAL FUND COMMUNITY ENHANCEMENT & DEVELOPMENT CORPORATION

SOUTHLAKE PARKS DEVELOPMENT CORPORATION CRIME CONTROL & PREVENTION DISTRICT

Positions. The budget proposes $45,000,000

adding three new full-time $40,000,000

positions to the General Fund.

An explanation of the changes is $35,000,000

provided as follows:

$30,000,000 $19,715,165 $19,908,000

$18,598,638

$25,000,000

DOLLARS $20,000,000 $14,111,661 $15,104,616 $15,660,985

$15,000,000 $6,851,800 $7,350,000 $7,423,500

$5,707,414 $5,734,078 $5,858,223

$10,000,000

$9,249,931 $9,800,000 $9,898,000

$5,000,000 $7,705,009 $7,741,005 $7,908,601

$- $1,923,567 $1,898,389 $1,921,480 $2,814,078 $2,400,000 $2,424,000

2018 2019 2020 2021 2022* 2023**

FISCAL YEAR

Figure 9: Sales tax collection trend

BUDGET BOOK | FY 2023 City of Southlake 21

WWW.CITYOFSOUTHLAKE.COM