Page 56 - FortWorthFY23AdoptedBudget

P. 56

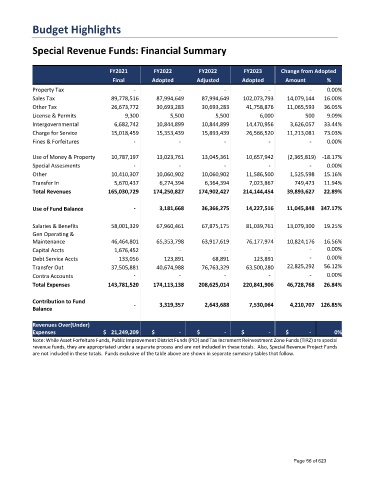

Budget Highlights

Special Revenue Funds: Financial Summary

FY2021 FY2022 FY2022 FY2023 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax - - - - - 0.00%

Sales Tax 89,778,516 87,994,649 87,994,649 102,073,793 14,079,144 16.00%

Other Tax 26,673,772 30,693,283 30,693,283 41,758,876 11,065,593 36.05%

License & Permits 9,300 5,500 5,500 6,000 500 9.09%

Intergovernmental 6,682,742 10,844,899 10,844,899 14,470,956 3,626,057 33.44%

Charge for Service 15,018,459 15,353,439 15,893,439 26,566,520 11,213,081 73.03%

Fines & Forfeitures - - - - - 0.00%

Use of Money & Property 10,787,197 13,023,761 13,045,361 10,657,942 (2,365,819) -18.17%

Special Assesments - - - - - 0.00%

Other 10,410,307 10,060,902 10,060,902 11,586,500 1,525,598 15.16%

Transfer In 5,670,437 6,274,394 6,364,394 7,023,867 749,473 11.94%

Total Revenues 165,030,729 174,250,827 174,902,427 214,144,454 39,893,627 22.89%

Use of Fund Balance - 3,181,668 36,366,275 14,227,516 11,045,848 347.17%

Salaries & Benefits 58,001,329 67,960,461 67,875,175 81,039,761 13,079,300 19.25%

Gen Operating &

Maintenance 46,464,801 65,353,798 63,917,619 76,177,974 10,824,176 16.56%

Capital Accts 1,676,452 - - - - 0.00%

Debt Service Accts 133,056 123,891 68,891 123,891 - 0.00%

Transfer Out 37,505,881 40,674,988 76,763,329 63,500,280 22,825,292 56.12%

Contra Accounts - - - - - 0.00%

Total Expenses 143,781,520 174,113,138 208,625,014 220,841,906 46,728,768 26.84%

Contribution to Fund - 3,319,357 2,643,688 7,530,064 4,210,707 126.85%

Balance

Revenues Over(Under)

Expenses $ 21,249,209 $ - $ - $ - $ - 0%

Note: While Asset Forfeiture Funds, Public Improvement District Funds (PID) and Tax Increment Reinvestment Zone Funds (TIRZ) are special

revenue funds, they are appropriated under a separate process and are not included in these totals. Also, Special Revenue Project Funds

are not included in these totals. Funds exclusive of the table above are shown in separate summary tables that follow.

Page 56 of 623