Page 51 - FortWorthFY23AdoptedBudget

P. 51

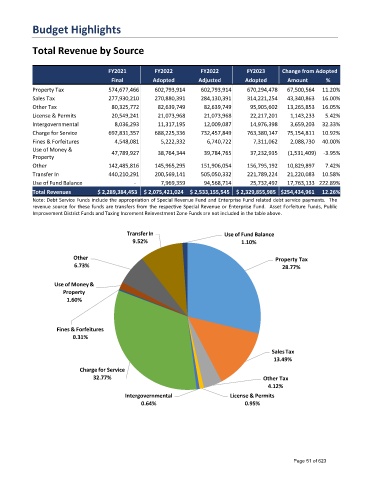

Budget Highlights

Total Revenue by Source

FY2021 FY2022 FY2022 FY2023 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 574,677,466 602,793,914 602,793,914 670,294,478 67,500,564 11.20%

Sales Tax 277,930,210 270,880,391 284,130,391 314,221,254 43,340,863 16.00%

Other Tax 80,325,772 82,639,749 82,639,749 95,905,602 13,265,853 16.05%

License & Permits 20,549,241 21,073,968 21,073,968 22,217,201 1,143,233 5.42%

Intergovernmental 8,036,293 11,317,195 12,009,087 14,976,398 3,659,203 32.33%

Charge for Service 692,831,357 688,225,336 732,457,849 763,380,147 75,154,811 10.92%

Fines & Forfeitures 4,548,081 5,222,332 6,740,722 7,311,062 2,088,730 40.00%

Use of Money & 47,789,927 38,764,344 39,784,765 37,232,935 (1,531,409) -3.95%

Property

Other 142,485,816 145,965,295 151,906,054 156,795,192 10,829,897 7.42%

Transfer In 440,210,291 200,569,141 505,050,332 221,789,224 21,220,083 10.58%

Use of Fund Balance - 7,969,359 94,568,714 25,732,492 17,763,133 222.89%

Total Revenues $ 2,289,384,453 $ 2,075,421,024 $ 2,533,155,545 $ 2,329,855,985 $254,434,961 12.26%

Note: Debt Service Funds include the appropriation of Special Revenue Fund and Enterprise Fund related debt service payments. The

revenue source for these funds are transfers from the respective Special Revenue or Enterprise Fund. Asset Forfeiture Funds, Public

Improvement District Funds and Taxing Increment Reinvestment Zone Funds are not included in the table above.

TransferIn Use of Fund Balance

9.52% 1.10%

Other Property Tax

6.73% 28.77%

Use of Money&

Property

1.60%

Fines & Forfeitures

0.31%

SalesTax

13.49%

Charge for Service

32.77% Other Tax

4.12%

Intergovernmental License & Permits

0.64% 0.95%

Page 51 of 623