Page 55 - FortWorthFY23AdoptedBudget

P. 55

Budget Highlights

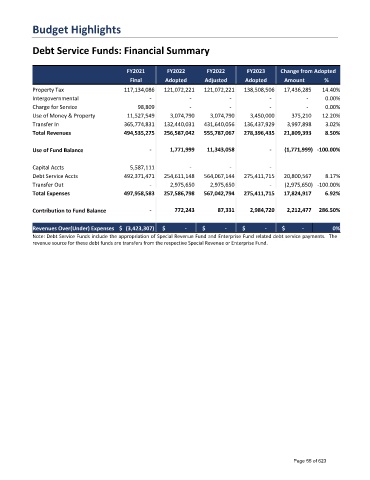

Debt Service Funds: Financial Summary

FY2021 FY2022 FY2022 FY2023 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 117,134,086 121,072,221 121,072,221 138,508,506 17,436,285 14.40%

Intergovernmental - - - - - 0.00%

Charge for Service 98,809 - - - - 0.00%

Use of Money & Property 11,527,549 3,074,790 3,074,790 3,450,000 375,210 12.20%

Transfer In 365,774,831 132,440,031 431,640,056 136,437,929 3,997,898 3.02%

Total Revenues 494,535,275 256,587,042 555,787,067 278,396,435 21,809,393 8.50%

Use of Fund Balance - 1,771,999 11,343,058 - (1,771,999) -100.00%

Capital Accts 5,587,111 - - -

Debt Service Accts 492,371,471 254,611,148 564,067,144 275,411,715 20,800,567 8.17%

Transfer Out - 2,975,650 2,975,650 - (2,975,650) -100.00%

Total Expenses 497,958,583 257,586,798 567,042,794 275,411,715 17,824,917 6.92%

Contribution to Fund Balance - 772,243 87,331 2,984,720 2,212,477 286.50%

Revenues Over(Under) Expenses $ (3,423,307) $ - $ - $ - $ - 0%

Note: Debt Service Funds include the appropriation of Special Revenue Fund and Enterprise Fund related debt service payments. The

revenue source for these debt funds are transfers from the respective Special Revenue or Enterprise Fund.

Page 55 of 623