Page 57 - FortWorthFY23AdoptedBudget

P. 57

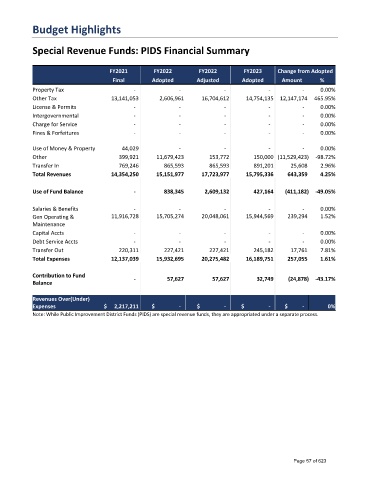

Budget Highlights

Special Revenue Funds: PIDS Financial Summary

FY2021 FY2022 FY2022 FY2023 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax - - - - - 0.00%

Other Tax 13,141,053 2,606,961 16,704,612 14,754,135 12,147,174 465.95%

License & Permits - - - - - 0.00%

Intergovernmental - - - - - 0.00%

Charge for Service - - - - - 0.00%

Fines & Forfeitures - - - - - 0.00%

Use of Money & Property 44,029 - - - - 0.00%

Other 399,921 11,679,423 153,772 150,000 (11,529,423) -98.72%

Transfer In 769,246 865,593 865,593 891,201 25,608 2.96%

Total Revenues 14,354,250 15,151,977 17,723,977 15,795,336 643,359 4.25%

Use of Fund Balance - 838,345 2,609,132 427,164 (411,182) -49.05%

Salaries & Benefits - - - - - 0.00%

Gen Operating & 11,916,728 15,705,274 20,048,061 15,944,569 239,294 1.52%

Maintenance

Capital Accts - - - - - 0.00%

Debt Service Accts - - - - - 0.00%

Transfer Out 220,311 227,421 227,421 245,182 17,761 7.81%

Total Expenses 12,137,039 15,932,695 20,275,482 16,189,751 257,055 1.61%

Contribution to Fund - 57,627 57,627 32,749 (24,878) -43.17%

Balance

Revenues Over(Under)

Expenses $ 2,217,211 $ - $ - $ - $ - 0%

Note: While Public Improvement District Funds (PIDS) are special revenue funds, they are appropriated under a separate process.

Page 57 of 623