Page 58 - FortWorthFY23AdoptedBudget

P. 58

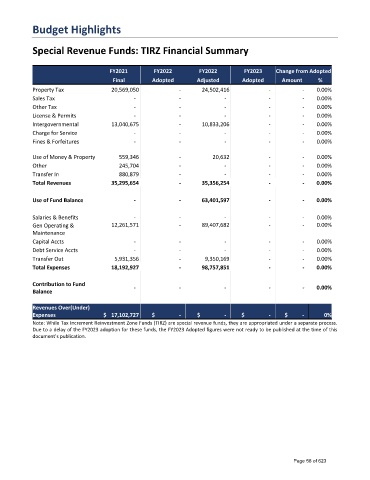

Budget Highlights

Special Revenue Funds: TIRZ Financial Summary

FY2021 FY2022 FY2022 FY2023 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 20,569,050 - 24,502,416 - - 0.00%

Sales Tax - - - - - 0.00%

Other Tax - - - - - 0.00%

License & Permits - - - - - 0.00%

Intergovernmental 13,040,675 - 10,833,206 - - 0.00%

Charge for Service - - - - - 0.00%

Fines & Forfeitures - - - - - 0.00%

Use of Money & Property 559,346 - 20,632 - - 0.00%

Other 245,704 - - - - 0.00%

Transfer In 880,879 - - - - 0.00%

Total Revenues 35,295,654 - 35,356,254 - - 0.00%

Use of Fund Balance - - 63,401,597 - - 0.00%

Salaries & Benefits - - - - - 0.00%

Gen Operating & 12,261,571 - 89,407,682 - - 0.00%

Maintenance

Capital Accts - - - - - 0.00%

Debt Service Accts - - - - - 0.00%

Transfer Out 5,931,356 - 9,350,169 - - 0.00%

Total Expenses 18,192,927 - 98,757,851 - - 0.00%

Contribution to Fund - - - - - 0.00%

Balance

Revenues Over(Under)

Expenses $ 17,102,727 $ - $ - $ - $ - 0%

Note: While Tax Increment Reinvestment Zone Funds (TIRZ) are special revenue funds, they are appropriated under a separate process.

Due to a delay of the FY2023 adoption for these funds, the FY2023 Adopted figures were not ready to be published at the time of this

document’s publication.

Page 58 of 623