Page 59 - FortWorthFY23AdoptedBudget

P. 59

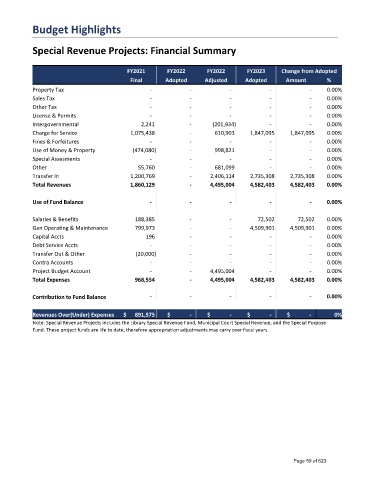

Budget Highlights

Special Revenue Projects: Financial Summary

FY2021 FY2022 FY2022 FY2023 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax - - - - - 0.00%

Sales Tax - - - - - 0.00%

Other Tax - - - - - 0.00%

License & Permits - - - - - 0.00%

Intergovernmental 2,241 - (201,934) - - 0.00%

Charge for Service 1,075,438 - 610,903 1,847,095 1,847,095 0.00%

Fines & Forfeitures - - - - - 0.00%

Use of Money & Property (474,080) - 998,821 - - 0.00%

Special Assesments - - - - - 0.00%

Other 55,760 - 681,099 - - 0.00%

Transfer In 1,200,769 - 2,406,114 2,735,308 2,735,308 0.00%

Total Revenues 1,860,129 - 4,495,004 4,582,403 4,582,403 0.00%

Use of Fund Balance - - - - - 0.00%

Salaries & Benefits 188,385 - - 72,502 72,502 0.00%

Gen Operating & Maintenance 799,973 - - 4,509,901 4,509,901 0.00%

Capital Accts 196 - - - - 0.00%

Debt Service Accts - - - - - 0.00%

Transfer Out & Other (20,000) - - - - 0.00%

Contra Accounts - - - - - 0.00%

Project Budget Account - - 4,495,004 - - 0.00%

Total Expenses 968,554 - 4,495,004 4,582,403 4,582,403 0.00%

Contribution to Fund Balance - - - - - 0.00%

Revenues Over(Under) Expenses $ 891,575 $ - $ - $ - $ - 0%

Note: Special Revenue Projects includes the Library Special Revenue Fund, Municipal Court Special Revenue, and the Special Purpose

Fund. These project funds are life to date, therefore appropriation adjustments may carry over fiscal years.

Page 59 of 623