Page 375 - Microsoft Word - FY 2021 tax info sheet

P. 375

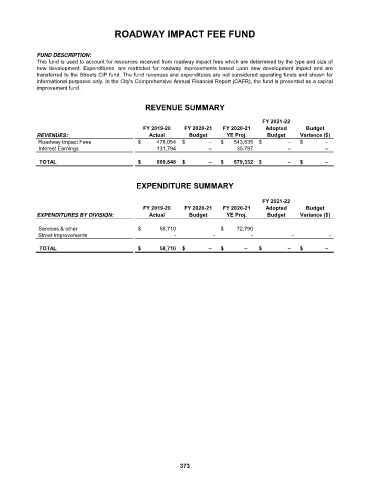

ROADWAY IMPACT FEE FUND

FUND DESCRIPTION:

This fund is used to account for resources received from roadway impact fees which are determined by the type and size of

new development. Expenditures are restricted for roadway improvements based upon new development impact and are

transferred to the Streets CIP fund. The fund revenues and expenditures are not considered operating funds and shown for

informational purposes only. In the City's Comprehensive Annual Financial Report (CAFR), the fund is presented as a capital

improvement fund.

REVENUE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

REVENUES: Actual Budget YE Proj. Budget Variance ($)

Roadway Impact Fees $ 478,054 $ – $ 543,535 $ – $ –

Interest Earnings 131,794 – 35,797 – –

TOTAL $ 609,848 $ – $ 579,332 $ – $ –

EXPENDITURE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

EXPENDITURES BY DIVISION: Actual Budget YE Proj. Budget Variance ($)

Services & other $ 58,710 $ 72,790

Street Improvements - - - - -

TOTAL $ 58,710 $ – $ – $ – $ –

373