Page 377 - Microsoft Word - FY 2021 tax info sheet

P. 377

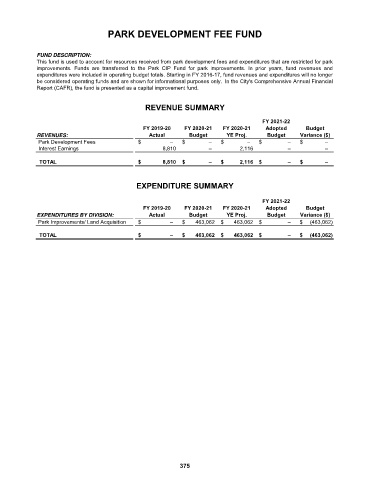

PARK DEVELOPMENT FEE FUND

FUND DESCRIPTION:

This fund is used to account for resources received from park development fees and expenditures that are restricted for park

improvements. Funds are transferred to the Park CIP Fund for park improvements. In prior years, fund revenues and

expenditures were included in operating budget totals. Starting in FY 2016-17, fund revenues and expenditures will no longer

be considered operating funds and are shown for informational purposes only. In the City's Comprehensive Annual Financial

Report (CAFR), the fund is presented as a capital improvement fund.

REVENUE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

REVENUES: Actual Budget YE Proj. Budget Variance ($)

Park Development Fees $ – $ – $ – $ – $ –

Interest Earnings 8,810 – 2,116 – –

TOTAL $ 8,810 $ – $ 2,116 $ – $ –

EXPENDITURE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

EXPENDITURES BY DIVISION: Actual Budget YE Proj. Budget Variance ($)

Park Improvements/ Land Acquisition $ – $ 463,062 $ 463,062 $ – $ (463,062)

TOTAL $ – $ 463,062 $ 463,062 $ – $ (463,062)

375