Page 13 - City of Crowley FY22 Operating Budget

P. 13

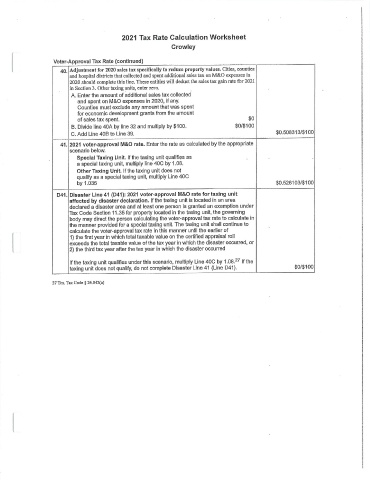

2021 Tax Rate Calculation Worksheet

Crowley

Voter- Approval Tax Rate ( continued)

40. Adjustment for 2020 sales tax specifically to reduce property values. Cities, counties

and hospital districts that collected and spent additional sales tax on M &O expenses in

2020 should complete this line. These entities will deduct the sales tax gain rate for 2021

in Section 3. Other taxing units, enter zero.

A. Enter the amount of additional sales tax collected

and spent on M &O expenses in 2020, if any.

Counties must exclude any amount that was spent

for economic development grants from the amount

of sales tax spent. $ 0

B. Divide line 40A by line 32 and multiply by $ 100. $ 0/$ 100

0. 508313/$ 100

C. Add Line 40B to Line 39.

41. 2021 voter - approval M &O rate. Enter the rate as calculated by the appropriate

scenario below.

Special Taxing Unit. If the taxing unit qualifies as

a special taxing unit, multiply line 40C by 1. 08,

Other Taxing Unit. If the taxing unit does not

qualify as a special taxing unit, multiply Line 40C

by 1. 035 0. 526103/$ 100

D41. Disaster Line 41 ( D41): 2021 voter - approval M &O rate for taxing unit

affected by disaster declaration. If the taxing unit is located in an area

declared a disaster area and at least one person is granted an exemption under

Tax Code Section 11. 35 for property located in the taxing unit, the governing

body may direct the person calculating the voter - approval tax rate to calculate in

the manner provided for a special taxing unit. The taxing unit shall continue to

calculate the voter - approval tax rate in this manner until the earlier of

1) the first year in which total taxable value on the certified appraisal roll

exceeds the total taxable value of the tax year in which the disaster occurred, or

2) the third tax year after the tax year in which the disaster occurred

If the taxing unit qualifies under this scenario, multiply Line 40C by 1. 08.27 If the

taxing unit does not qualify, do not complete Disaster Line 41 ( Line D41). 0/$ 100

27 Tex. Tax Code § 26.042( a)