Page 9 - City of Crowley FY22 Operating Budget

P. 9

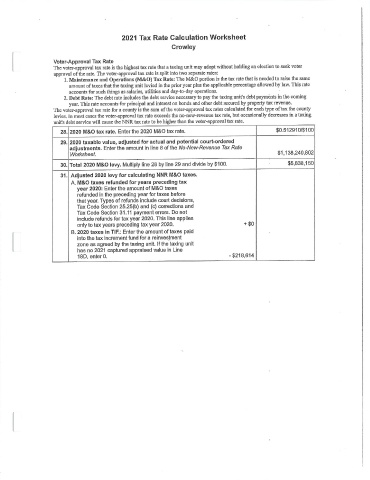

2021 Tax Rate Calculation Worksheet

Crowley

Voter - Approval Tax Rate

The voter - approval tax rate is the highest tax rate that a taxing unit may adopt without holding an election to seek voter

approval ofthe rate. The voter - approval tax rate is split into two separate rates:

1, Maintenance and Operations (M &O) Tax Rate: The M&O portion is the tax rate that is needed to raise the same

amount of taxes that the taxing unit levied in the prior year plus the applicable percentage allowed by law, This rate

accounts for such things as salaries, utilities and day -to -day operations.

2, Debt Rate: The debt rate includes the debt service necessary to pay the taxing unit's debt payments in the coming

year. This rate accounts for principal and interest on bonds and other debt secured by property tax revenue.

The voter- approval tax rate for a county is the sum of the voter - approval tax rates calculated for each type of tax the county

levies, In most cases the voter - approval tax rate exceeds the no -new- revenue tax rate, but occasionally decreases in a taxing

unit's debt service will cause the NNR tax rate to be higher than the voter - approval tax rate.

0. 5129101$100

28. 2020 M &O tax rate. Enter the 2020 M &O tax rate.

29. 2020 taxable value, adjusted for actual and potential court - ordered

adjustments. Enter the amount in line 8 of the No- New- Revenue Tax Rafe

1, 138, 240, 802

Worksheet.

30. Total 2020 M &O levy, Multiply line 28 by line 29 and divide by $ 100. 5, 838, 150

31. Adjusted 2020 levy for calculating NNR M &O taxes.

A. M &O taxes refunded for years preceding tax

year 2020: Enter the amount of M &O taxes

refunded in the preceding year for taxes before

that year. Types of refunds include court decisions,

Tax Code Section 25.25( b) and ( c) corrections and

Tax Code Section 31. 11 payment errors. Do not

include refunds for tax year 2020. This line applies

only to tax years preceding tax year 2020. +$ 0

B. 2020 taxes in TIF.: Enter the amount of taxes paid

into the tax increment fund for a reinvestment

zone as agreed by the taxing unit. If the taxing unit

has no 2021 captured appraised value in Line

18D, enter 0. -$ 218, 614