Page 11 - City of Crowley FY22 Operating Budget

P. 11

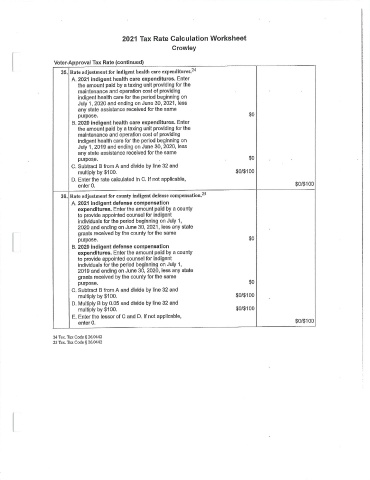

2021 Tax Rate Calculation Worksheet

Crowley

Voter - Approval Tax Rate ( continued)

35. Rate adjustment for indigent health care expenditures.24

A. 2021 indigent health care expenditures. Enter

the amount paid by a taxing unit providing for the

maintenance and operation cost of providing

indigent health care for the period beginning on

July 1, 2020 and ending on June 30, 2021, less

any state assistance received for the same

0

purpose. $

B. 2020 indigent health care expenditures. Enter

the amount paid by a taxing unit providing for the

maintenance and operation cost of providing

indigent health care for the period beginning on

July 1, 2019 and ending on June 30, 2020, less

any state assistance received for the same

0

purpose. $

C. Subtract B from A and divide by line 32 and

multiply by $ 100. $ 0/$ 100

D. Enter the rate calculated in C, If not applicable,

0/$ 100

enter 0.

X Rate adjustment for county indigent defense compensation.2$

A. 2021 indigent defense compensation

expenditures. Enter the amount paid by a county

to provide appointed counsel for indigent

individuals for the period beginning on July 1,

2020 and ending on June 30, 2021, less any state

grants received by the county for the same

0

purpose. $

B. 2020 indigent defense compensation

expenditures. Enter the amount paid by a county

to provide appointed counsel for indigent

individuals for the period beginning on July 1,

2019 and ending on June 30, 2020, less any state

grants received by the county for the same

0

purpose. $

C. Subtract B from A and divide by line 32 and

multiply by $ 100. $ 0/$ 100

D. Multiply B by 0.05 and divide by line 32 and

multiply by $100. $ 0/$ 100

E. Enter the lessor of C and D. If not applicable,

0/$ 100

enter 0.

24 Tex. Tax Code § 26.0442

25 Tex. Tax Code § 26.0442