Page 15 - City of Crowley FY22 Operating Budget

P. 15

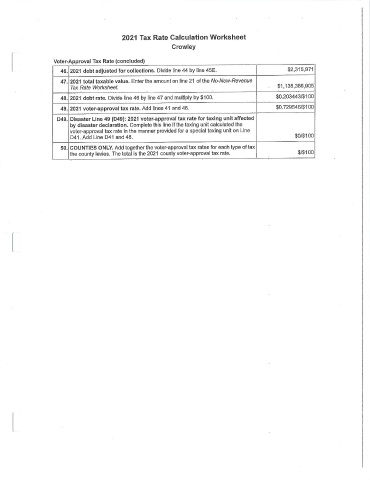

2021 Tax Rate Calculation Worksheet

Crowley

Voter - Approval Tax Rate (concluded)

2021 debt adjusted for collections. Divide line 44 by line 45E. 2, 315, 971

F . 1, 138, 386, 905

47. 2021 total taxable value. Enter the amount on line 21 of the No- New - Revenue

Tax Rate Worksheet.

48. 2021 debt rate. Divide line 46 by line 47 and multiply by $ 100. 0. 203443/$ 100

0. 729546/$ 100

49. 2021 voter - approval tax rate. Add lines 41 and 48.

D49. Disaster Line 49 (D49): 2021 voter- approval tax rate for taxing unit affected

by disaster declaration. Complete this line if the taxing unit calculated the

voter- approval tax rate in the manner provided for a special taxing unit on Line

D41. Add Line D41 and 48. 0/$ 100

50. COUNTIES ONLY. Add together the voter - approval tax rates for each type of tax

100

the county levies. The total is the 2021 county voter - approval tax rate.