Page 8 - City of Crowley FY22 Operating Budget

P. 8

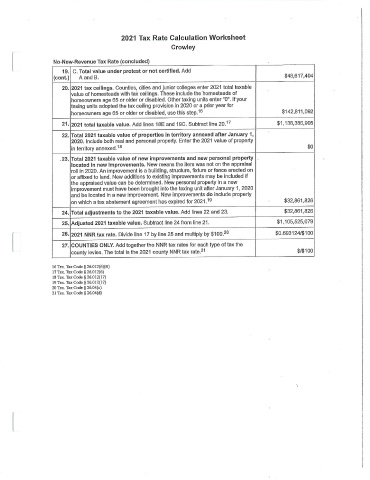

2021 Tax Rate Calculation Worksheet

Crowley

No- New - Revenue Tax Rate ( concluded)

19. C. Total value under protest or not certified. Add

48,617,404

cont.) A and B.

20. 2021 tax ceilings. Counties, cities and junior colleges enter 2021 total taxable

value of homesteads with tax ceilings. These include the homesteads of

homeowners age 65 or older or disabled. Other taxing units enter "0 ". If your

taxing units adopted the tax ceiling provision in 2020 or a prior year for

homeowners age 65 or older or disabled, use this step. 16 142, 811, 092

21. 2021 total taxable value. Add lines 18E and 19C. Subtract line 20.17 1, 138, 386, 905

22. Total 2021 taxable value of properties in territory annexed after January 1,

2020. Include both real and personal property. Enter the 2021 value of property

in territory annexed.18 0

23. Total 2021 taxable value of new improvements and new personal property

located in new improvements. New means the item was not on the appraisal

roll in 2020. An improvement is a building, structure, fixture or fence erected on

or affixed to land. New additions to existing improvements may be included if

the appraised value can be determined, New personal property in a new

improvement must have been brought into the taxing unit after January 1, 2020

and be located in a new improvement. New improvements do include property

on which a tax abatement agreement has expired for 2021. 19 32, 861, 826

24. Total adjustments to the 2021 taxable value. Add lines 22 and 23. 32, 861, 826

25. Adjusted 2021 taxable value. Subtract line 24 from line 21. 1, 105, 525, 079

26. 2021 NNR tax rate. Divide line 17 by line 25 and multiply by $ 100.20 0, 693124/$ 100

27. COUNTIES ONLY. Add together the NNR tax rates for each type of tax the

county levies, The total is the 2021 county NNR tax rate.21 100

16 Tex. Tax Code § 26. 012( 6)( B)

17 Tex. Tax Code § 26. 012( 6)

18 Tex. Tax Code § 26. 012( 17)

19 Tex. Tax Code § 26.012( 17)

20 Tex. Tax Code § 26.04( c)

21 Tex. Tax Cade § 26.04( d)