Page 101 - Hurst Budget FY21

P. 101

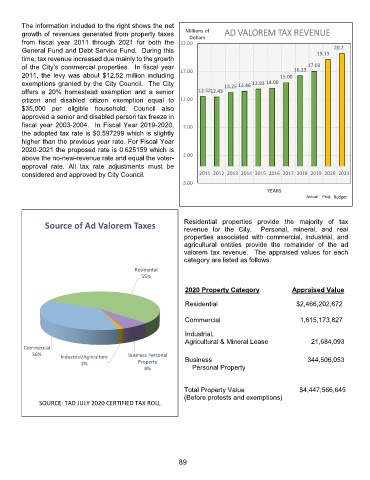

The information included to the right shows the net

growth of revenues generated from property taxes Millions of AD VALOREM TAX REVENUE

Dollars

from fiscal year 2011 through 2021 for both the 22.00

General Fund and Debt Service Fund. During this 19.13 20.2

time, tax revenue increased due mainly to the growth

of the City’s commercial properties. In fiscal year 17.00 16.23 17.03

2011, the levy was about $12.52 million including 15.00

exemptions granted by the City Council. The City 13.25 13.46 13.83 14.00

offers a 20% homestead exemption and a senior 12.5212.43

citizen and disabled citizen exemption equal to 12.00

$35,000 per eligible household. Council also

approved a senior and disabled person tax freeze in

fiscal year 2003-2004. In Fiscal Year 2019-2020, 7.00

the adopted tax rate is $0.597299 which is slightly

higher than the previous year rate. For Fiscal Year

2020-2021 the proposed rate is 0.625159 which is

above the no-new-revenue rate and equal the voter- 2.00

approval rate. All tax rate adjustments must be

considered and approved by City Council. 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

-3.00

YEARS

Actual Proj. Budget

Source of Ad Valorem Taxes Residential properties provide the majority of tax

revenue for the City. Personal, mineral, and real

properties associated with commercial, industrial, and

agricultural entities provide the remainder of the ad

valorem tax revenue. The appraised values for each

category are listed as follows:

Residental

55%

2020 Property Category Appraised Value

Residential $2,466,202,672

Commercial 1,615,173,827

Industrial,

Agricultural & Mineral Lease 21,684,093

Commercial

36% Industrial/Agriculture Business Personal

1% Property Business 344,506,053

8% Personal Property

Total Property Value $4,447,566,645

(Before protests and exemptions)

SOURCE: TAD JULY 2020 CERTIFIED TAX ROLL

89