Page 105 - Hurst Budget FY21

P. 105

AD VALOREM TAX VS. SALES TAX

COMPARISON

Millions

22.0

21.0 20.2

20.0 19.1

19.0

18.0 17.0

17.0 16.2

16.0 15.0

15.0 14.0

14.0 13.3 13.5 13.8

13.0 12.512.4

12.0

11.0

10.0 10.8 10.8

9.0 10.1 10.5 10.6 10.5

8.0 9.5 9.7 9.7 9.3 8.3

7.0

6.0

5.0

4.0

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

AD VALOREM TAX SALES TAX

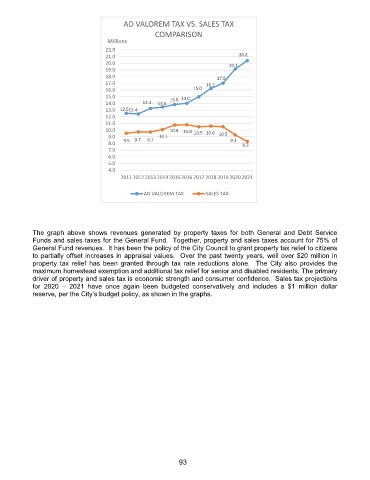

The graph above shows revenues generated by property taxes for both General and Debt Service

Funds and sales taxes for the General Fund. Together, property and sales taxes account for 75% of

General Fund revenues. It has been the policy of the City Council to grant property tax relief to citizens

to partially offset increases in appraisal values. Over the past twenty years, well over $20 million in

property tax relief has been granted through tax rate reductions alone. The City also provides the

maximum homestead exemption and additional tax relief for senior and disabled residents. The primary

driver of property and sales tax is economic strength and consumer confidence. Sales tax projections

for 2020 – 2021 have once again been budgeted conservatively and includes a $1 million dollar

reserve, per the City’s budget policy, as shown in the graphs.

93