Page 100 - Hurst Budget FY21

P. 100

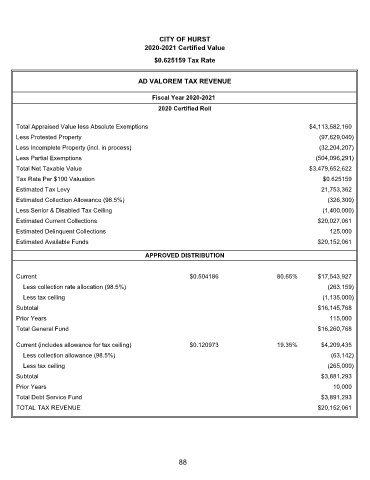

CITY OF HURST

2020-2021 Certified Value

$0.625159 Tax Rate

AD VALOREM TAX REVENUE

Fiscal Year 2020-2021

2020 Certified Roll

Total Appraised Value less Absolute Exemptions $4,113,582,160

Less Protested Property (97,629,040)

Less Incomplete Property (incl. in process) (32,204,207)

Less Partial Exemptions (504,096,291)

Total Net Taxable Value $3,479,652,622

Tax Rate Per $100 Valuation $0.625159

Estimated Tax Levy 21,753,362

Estimated Collection Allowance (98.5%) (326,300)

Less Senior & Disabled Tax Ceiling (1,400,000)

Estimated Current Collections $20,027,061

Estimated Delinquent Collections 125,000

Estimated Available Funds $20,152,061

APPROVED DISTRIBUTION

Current $0.504186 80.65% $17,543,927

Less collection rate allocation (98.5%) (263,159)

Less tax ceiling (1,135,000)

Subtotal $16,145,768

Prior Years 115,000

Total General Fund $16,260,768

Current (includes allowance for tax ceiling) $0.120973 19.35% $4,209,435

Less collection allowance (98.5%) (63,142)

Less tax ceiling (265,000)

Subtotal $3,881,293

Prior Years 10,000

Total Debt Service Fund $3,891,293

TOTAL TAX REVENUE $20,152,061

88