Page 96 - Hurst Budget FY21

P. 96

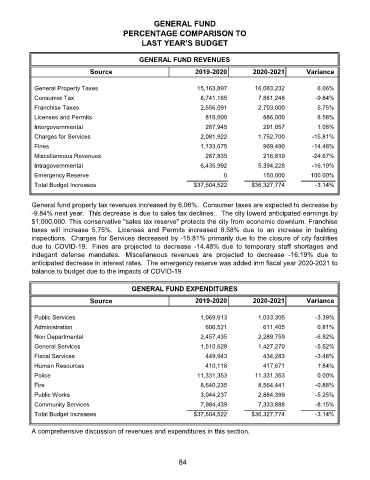

GENERAL FUND

PERCENTAGE COMPARISON TO

LAST YEAR'S BUDGET

GENERAL FUND REVENUES

Source 2019-2020 2020-2021 Variance

General Property Taxes 15,163,897 16,083,232 6.06%

Consumer Tax 8,741,165 7,881,248 -9.84%

Franchise Taxes 2,556,091 2,703,000 5.75%

Licenses and Permits 816,000 886,000 8.58%

Intergovernmental 287,945 291,057 1.08%

Charges for Services 2,081,922 1,752,700 -15.81%

Fines 1,133,675 969,490 -14.48%

Miscellaneous Revenues 287,835 216,819 -24.67%

Intragovernmental 6,435,992 5,394,228 -16.19%

Emergency Reserve 0 150,000 100.00%

Total Budget Increases $37,504,522 $36,327,774 -3.14%

General fund property tax revenues increased by 6.06%. Consumer taxes are expected to decrease by

-9.84% next year. This decrease is due to sales tax declines.. The city lowerd anticipated earnings by

$1,000,000. This conservative "sales tax reserve" protects the city from economic downturn. Franchise

taxes will increase 5.75%. Licenses and Permits increased 8.58% due to an increase in building

inspections. Charges for Services decreased by -15.81% primarily due to the closure of city facilities

due to COVID-19. Fines are projected to decrease -14.48% due to temporary staff shortages and

indegant defense mandates. Miscellaneous revenues are projected to decrease -16.19% due to

anticipated decrease in interest rates. The emergency reserve was added imn fiscal year 2020-2021 to

balance to budget due to the impacts of COVID-19

GENERAL FUND EXPENDITURES

Source 2019-2020 2020-2021 Variance

Public Services 1,069,613 1,033,305 -3.39%

Administration 606,521 611,405 0.81%

Non Departmental 2,457,435 2,289,759 -6.82%

General Services 1,510,628 1,427,270 -5.52%

Fiscal Services 449,943 434,283 -3.48%

Human Resources 410,118 417,671 1.84%

Police 11,331,353 11,331,353 0.00%

Fire 8,640,235 8,564,441 -0.88%

Public Works 3,044,237 2,884,399 -5.25%

Community Services 7,984,439 7,333,888 -8.15%

Total Budget Increases $37,504,522 $36,327,774 -3.14%

A comprehensive discussion of revenues and expenditures in this section.

84