Page 103 - Hurst Budget FY21

P. 103

TOTAL TAX BURDEN

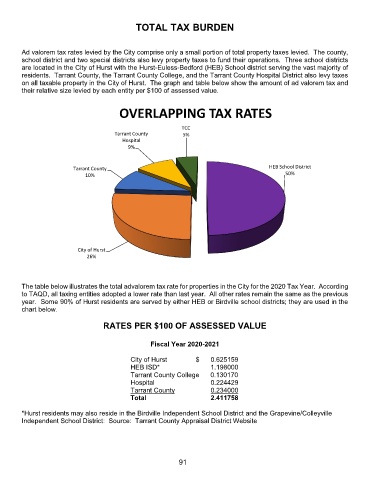

Ad valorem tax rates levied by the City comprise only a small portion of total property taxes levied. The county,

school district and two special districts also levy property taxes to fund their operations. Three school districts

are located in the City of Hurst with the Hurst-Euless-Bedford (HEB) School district serving the vast majority of

residents. Tarrant County, the Tarrant County College, and the Tarrant County Hospital District also levy taxes

on all taxable property in the City of Hurst. The graph and table below show the amount of ad valorem tax and

their relative size levied by each entity per $100 of assessed value.

OVERLAPPING TAX RATES

TCC

Tarrant County 5%

Hospital

9%

Tarrant County HEB School District

10% 50%

City of Hurst

26%

The table below illustrates the total advalorem tax rate for properties in the City for the 2020 Tax Year. According

to TAQD, all taxing entities adopted a lower rate than last year. All other rates remain the same as the previous

year. Some 90% of Hurst residents are served by either HEB or Birdville school districts; they are used in the

chart below.

RATES PER $100 OF ASSESSED VALUE

Fiscal Year 2020-2021

City of Hurst $ 0.625159

HEB ISD* 1.198000

Tarrant County College 0.130170

Hospital 0.224429

Tarrant County 0.234000

Total 2.411758

*Hurst residents may also reside in the Birdville Independent School District and the Grapevine/Colleyville

Independent School District: Source: Tarrant County Appraisal District Website

91