Page 111 - City of Westlake FY20 Budget

P. 111

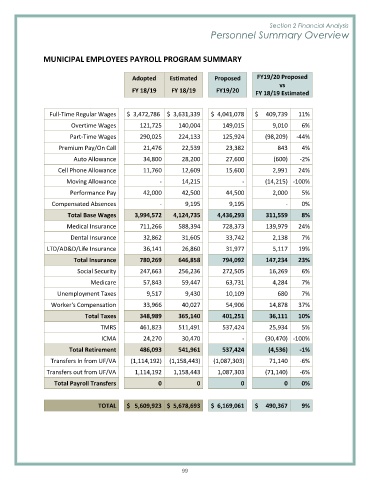

Section 2 Financial Analysis

Personnel Summary Overview

MUNICIPAL EMPLOYEES PAYROLL PROGRAM SUMMARY

Adopted Estimated Proposed FY19/20 Proposed

vs

FY 18/19 FY 18/19 FY19/20 FY 18/19 Estimated

Full-Time Regular Wages $ 3,472,786 $ 3,631,339 $ 4,041,078 $ 409,739 11%

Overtime Wages 121,725 140,004 149,015 9,010 6%

Part-Time Wages 290,025 224,133 125,924 (98,209) -44%

Premium Pay/On Call 21,476 22,539 23,382 843 4%

Auto Allowance 34,800 28,200 27,600 (600) -2%

Cell Phone Allowance 11,760 12,609 15,600 2,991 24%

Moving Allowance - 14,215 - (14,215) -100%

Performance Pay 42,000 42,500 44,500 2,000 5%

Compensated Absences - 9,195 9,195 - 0%

Total Base Wages 3,994,572 4,124,735 4,436,293 311,559 8%

Medical Insurance 711,266 588,394 728,373 139,979 24%

Dental Insurance 32,862 31,605 33,742 2,138 7%

LTD/AD&D/Life Insurance 36,141 26,860 31,977 5,117 19%

Total Insurance 780,269 646,858 794,092 147,234 23%

Social Security 247,663 256,236 272,505 16,269 6%

Medicare 57,843 59,447 63,731 4,284 7%

Unemployment Taxes 9,517 9,430 10,109 680 7%

Worker's Compensation 33,966 40,027 54,906 14,878 37%

Total Taxes 348,989 365,140 401,251 36,111 10%

TMRS 461,823 511,491 537,424 25,934 5%

ICMA 24,270 30,470 - (30,470) -100%

Total Retirement 486,093 541,961 537,424 (4,536) -1%

Transfers In from UF/VA (1,114,192) (1,158,443) (1,087,303) 71,140 -6%

Transfers out from UF/VA 1,114,192 1,158,443 1,087,303 (71,140) -6%

Total Payroll Transfers 0 0 0 0 0%

TOTAL $ 5,609,923 $ 5,678,693 $ 6,169,061 $ 490,367 9%

99