Page 106 - City of Westlake FY20 Budget

P. 106

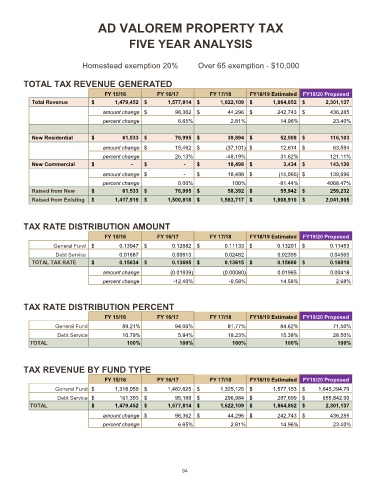

AD VALOREM PROPERTY TAX

FIVE YEAR ANALYSIS

Homestead exemption 20% Over 65 exemption - $10,000

TOTAL TAX REVENUE GENERATED

FY 15/16 FY 16/17 FY 17/18 FY18/19 Estimated FY19/20 Proposed

Total Revenue $ 1,479,452 $ 1,577,814 $ 1,622,109 $ 1,864,852 $ 2,301,137

amount change $ 98,362 $ 44,296 $ 242,743 $ 436,285

percent change 6.65% 2.81% 14.96% 23.40%

New Residential $ 61,533 $ 76,995 $ 39,894 $ 52,508 $ 116,103

amount change $ 15,462 $ (37,101) $ 12,614 $ 63,594

percent change 25.13% -48.19% 31.62% 121.11%

New Commercial $ - $ - $ 18,498 $ 3,434 $ 143,130

amount change $ - $ 18,498 $ (15,065) $ 139,696

percent change 0.00% 100% -81.44% 4068.47%

Raised from New $ 61,533 $ 76,995 $ 58,392 $ 55,942 $ 259,232

Raised from Existing $ 1,417,919 $ 1,500,818 $ 1,563,717 $ 1,808,910 $ 2,041,905

TAX RATE DISTRIBUTION AMOUNT

FY 15/16 FY 16/17 FY 17/18 FY18/19 Estimated FY19/20 Proposed

General Fund $ 0.13947 $ 0.12882 $ 0.11133 $ 0.13201 $ 0.11453

Debt Service 0.01687 0.00813 0.02482 0.02399 0.04565

TOTAL TAX RATE $ 0.15634 $ 0.13695 $ 0.13615 $ 0.15600 $ 0.16018

amount change (0.01939) (0.00080) 0.01985 0.00418

percent change -12.40% -0.58% 14.58% 2.68%

TAX RATE DISTRIBUTION PERCENT

FY 15/16 FY 16/17 FY 17/18 FY18/19 Estimated FY19/20 Proposed

General Fund 89.21% 94.06% 81.77% 84.62% 71.50%

Debt Service 10.79% 5.94% 18.23% 15.38% 28.50%

TOTAL 100% 100% 100% 100% 100%

TAX REVENUE BY FUND TYPE

FY 15/16 FY 16/17 FY 17/18 FY18/19 Estimated FY19/20 Proposed

General Fund $ 1,318,059 $ 1,482,625 $ 1,325,125 $ 1,577,153 $ 1,645,294.70

Debt Service $ 161,393 $ 95,189 $ 296,984 $ 287,699 $ 655,842.00

TOTAL $ 1,479,452 $ 1,577,814 $ 1,622,109 $ 1,864,852 $ 2,301,137

amount change $ 98,362 $ 44,296 $ 242,743 $ 436,285

percent change 6.65% 2.81% 14.96% 23.40%

94