Page 104 - City of Westlake FY20 Budget

P. 104

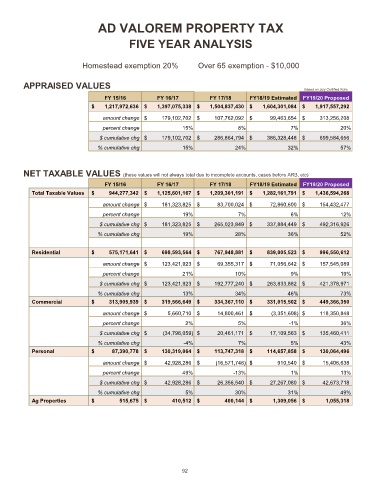

AD VALOREM PROPERTY TAX

FIVE YEAR ANALYSIS

Homestead exemption 20% Over 65 exemption - $10,000

APPRAISED VALUES

Based on July Certified Rolls

FY 15/16 FY 16/17 FY 17/18 FY18/19 Estimated FY19/20 Proposed

$ 1,217,972,636 $ 1,397,075,338 $ 1,504,837,430 $ 1,604,301,084 $ 1,917,557,292

amount change $ 179,102,702 $ 107,762,092 $ 99,463,654 $ 313,256,208

percent change 15% 8% 7% 20%

$ cumulative chg $ 179,102,702 $ 286,864,794 $ 386,328,448 $ 699,584,656

% cumulative chg 15% 24% 32% 57%

NET TAXABLE VALUES (these values will not always total due to incomplete accounts, cases before ARB, etc)

FY 15/16 FY 16/17 FY 17/18 FY18/19 Estimated FY19/20 Proposed

Total Taxable Values $ 944,277,342 $ 1,125,601,167 $ 1,209,301,191 $ 1,282,161,791 $ 1,436,594,268

amount change $ 181,323,825 $ 83,700,024 $ 72,860,600 $ 154,432,477

percent change 19% 7% 6% 12%

$ cumulative chg $ 181,323,825 $ 265,023,849 $ 337,884,449 $ 492,316,926

% cumulative chg 19% 28% 36% 52%

Residential $ 575,171,641 $ 698,593,564 $ 767,948,881 $ 839,005,523 $ 996,550,612

amount change $ 123,421,923 $ 69,355,317 $ 71,056,642 $ 157,545,089

percent change 21% 10% 9% 19%

$ cumulative chg $ 123,421,923 $ 192,777,240 $ 263,833,882 $ 421,378,971

% cumulative chg 13% 34% 46% 73%

Commercial $ 313,905,939 $ 319,566,649 $ 334,367,110 $ 331,015,502 $ 449,366,350

amount change $ 5,660,710 $ 14,800,461 $ (3,351,608) $ 118,350,848

percent change 2% 5% -1% 36%

$ cumulative chg $ (34,796,059) $ 20,461,171 $ 17,109,563 $ 135,460,411

% cumulative chg - 4 % 7 % 5 % 4 3 %

Personal $ 87,390,778 $ 130,319,064 $ 113,747,318 $ 114,657,858 $ 130,064,496

amount change $ 42,928,286 $ (16,571,746) $ 910,540 $ 15,406,638

percent change 49% -13% 1% 13%

$ cumulative chg $ 42,928,286 $ 26,356,540 $ 27,267,080 $ 42,673,718

% cumulative chg 5% 30% 31% 49%

Ag Properties $ 515,675 $ 410,512 $ 400,144 $ 1,309,056 $ 1,055,318

92