Page 105 - City of Westlake FY20 Budget

P. 105

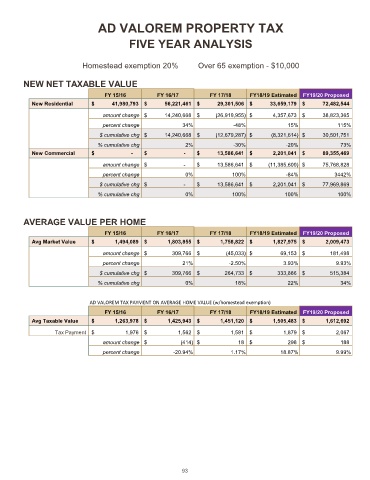

AD VALOREM PROPERTY TAX

FIVE YEAR ANALYSIS

Homestead exemption 20% Over 65 exemption - $10,000

NEW NET TAXABLE VALUE

FY 15/16 FY 16/17 FY 17/18 FY18/19 Estimated FY19/20 Proposed

New Residential $ 41,980,793 $ 56,221,461 $ 29,301,506 $ 33,659,179 $ 72,482,544

amount change $ 14,240,668 $ (26,919,955) $ 4,357,673 $ 38,823,365

percent change 34% -48% 15% 115%

$ cumulative chg $ 14,240,668 $ (12,679,287) $ (8,321,614) $ 30,501,751

% cumulative chg 2% -30% -20% 73%

New Commercial $ - $ - $ 13,586,641 $ 2,201,041 $ 89,355,469

amount change $ - $ 13,586,641 $ (11,385,600) $ 75,768,828

percent change 0% 100% -84% 3442%

$ cumulative chg $ - $ 13,586,641 $ 2,201,041 $ 77,969,869

% cumulative chg 0% 100% 100% 100%

AVERAGE VALUE PER HOME

FY 15/16 FY 16/17 FY 17/18 FY18/19 Estimated FY19/20 Proposed

Avg Market Value $ 1,494,089 $ 1,803,855 $ 1,758,822 $ 1,827,975 $ 2,009,473

amount change $ 309,766 $ (45,033) $ 69,153 $ 181,498

percent change 21% -2.50% 3.93% 9.93%

$ cumulative chg $ 309,766 $ 264,733 $ 333,886 $ 515,384

% cumulative chg 0% 18% 22% 34%

AD VALOREM TAX PAYMENT ON AVERAGE HOME VALUE (w/homestead exemption)

FY 15/16 FY 16/17 FY 17/18 FY18/19 Estimated FY19/20 Proposed

Avg Taxable Value $ 1,263,978 $ 1,425,943 $ 1,451,120 $ 1,505,483 $ 1,612,692

Tax Payment $ 1,976 $ 1,562 $ 1,581 $ 1,879 $ 2,067

amount change $ (414) $ 18 $ 298 $ 188

percent change -20.94% 1.17% 18.87% 9.99%

93