Page 122 - Southlake FY20 Budget

P. 122

City Profile

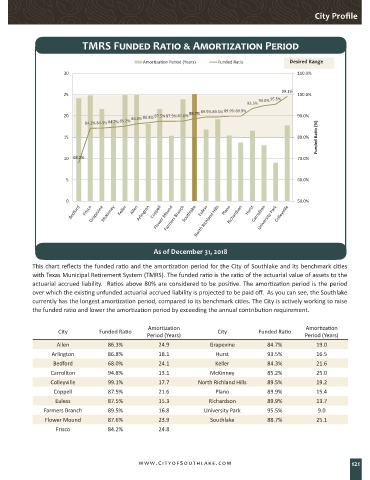

TMRS Funded Ratio & Amortization Period

Amortization Period (Years) Funded Ratio Desired Range

30 110.0%

99.1%

25 100.0%

94.8% 95.5%

93.5%

88.7% 89.5% 89.5% 89.9% 89.9%

20 86.3% 86.8% 87.5% 87.5% 87.6% 90.0%

84.2% 84.3% 84.7% 85.2%

Funded Ratio (%)

15 80.0%

10 68.0% 70.0%

5 60.0%

0 50.0%

Population

As of December 31, 2018 FTEs

This chart reflects the funded ratio and the amortization period for the City of Southlake and its benchmark cities

with Texas Municipal Retirement System (TMRS). The funded ratio is the ratio of the actuarial value of assets to the

actuarial accrued liability. Ratios above 80% are considered to be positive. The amortization period is the period

over which the existing unfunded actuarial accrued liability is projected to be paid off. As you can see, the Southlake

currently has the longest amortization period, compared to its benchmark cities. The City is actively working to raise

the funded ratio and lower the amortization period by exceeding the annual contribution requirement.

Amortization Amortization

City Funded Ratio City Funded Ratio

Period (Years) Period (Years)

Allen 86.3% 24.9 Grapevine 84.7% 19.0

Arlington 86.8% 18.1 Hurst 93.5% 16.5

Bedford 68.0% 24.1 Keller 84.3% 21.6

Carrollton 94.8% 13.1 McKinney 85.2% 25.0

Colleyville 99.1% 17.7 North Richland Hills 89.5% 19.2

Coppell 87.5% 21.6 Plano 89.9% 15.4

Euless 87.5% 15.3 Richardson 89.9% 13.7

Farmers Branch 89.5% 16.8 University Park 95.5% 9.0

Flower Mound 87.6% 23.9 Southlake 88.7% 25.1

Frisco 84.2% 24.8

www.CityofSouthlake.com 121