Page 119 - Southlake FY20 Budget

P. 119

City Profile

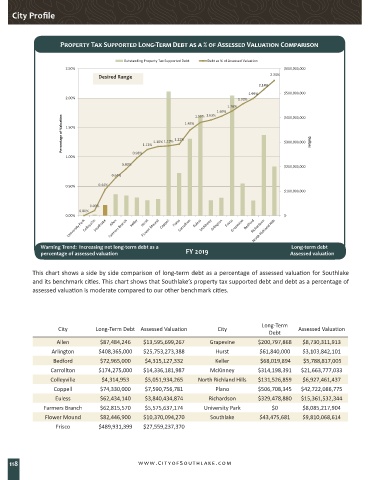

Property Tax Supported Long-Term Debt as a % of Assessed Valuation Comparison

Outstanding Property Tax Supported Debt Debt as % of Assessed Valuation

2.50% $600,000,000

Desired Range 2.30%

2.14%

1.99% $500,000,000

2.00% 1.90%

1.78%

1.69% $400,000,000

1.59% 1.63%

Percentage of Valuation 1.50% 1.13% 1.18% 1.19% 1.22% 1.45% $300,000,000 Dollars

1.00% 0.98%

0.80%

$200,000,000

0.64%

0.50% 0.44%

$100,000,000

0.09%

0.00%

0.00% $-

Warning Trend: Increasing net long-term debt as a Long-term debt

percentage of assessed valuation FY 2019 Assessed valuation

This chart shows a side by side comparison of long-term debt as a percentage of assessed valuation for Southlake

and its benchmark cities. This chart shows that Southlake’s property tax supported debt and debt as a percentage of

assessed valuation is moderate compared to our other benchmark cities.

Long-Term

City Long-Term Debt Assessed Valuation City Assessed Valuation

Debt

Allen $87,484,246 $13,595,699,267 Grapevine $200,797,868 $8,730,311,913

Arlington $408,365,000 $25,753,273,388 Hurst $61,840,000 $3,103,842,101

Bedford $72,965,000 $4,315,127,332 Keller $68,019,894 $5,788,817,005

Carrollton $174,275,000 $14,336,181,987 McKinney $314,198,391 $21,663,777,033

Colleyville $4,314,953 $5,051,934,265 North Richland Hills $131,526,859 $6,927,461,437

Coppell $74,330,000 $7,590,756,781 Plano $506,708,345 $42,722,086,775

Euless $62,434,140 $3,840,434,874 Richardson $329,478,880 $15,361,532,344

Farmers Branch $62,815,570 $5,575,637,174 University Park $0 $8,085,217,904

Flower Mound $82,446,900 $10,370,094,270 Southlake $43,475,681 $9,810,068,614

Frisco $489,931,399 $27,559,237,370

118 www.CityofSouthlake.com