Page 161 - Mansfieldr FY20 Approved Budget

P. 161

TAX ASSESSING AND COLLECTION DEPARTMENT

MISSION STATEMENT:

The Tax Assessing and Collection Department mission is to provide cost effective service in the

collection of current property tax collection, delinquent property tax accounts and provide accurate

accounting of the property tax collections for the City of Mansfield.

Department at a Glance

The Tax Assessing and Collection function is performed via contract with the Tarrant County Tax

Assessor-Collector. The department has no staffing. No increase to the operating budget has been

projected for FY 2019-2020.

Key Goals and Objectives

Goal

Provide a cost effective and efficient service to the citizens.

Objectives:

• Contract with Tarrant County for the collection of all taxes.

• Record and report monthly tax collections to the Business Services Division.

Performance Objectives

• Ensure the efficient collection of all property taxes.

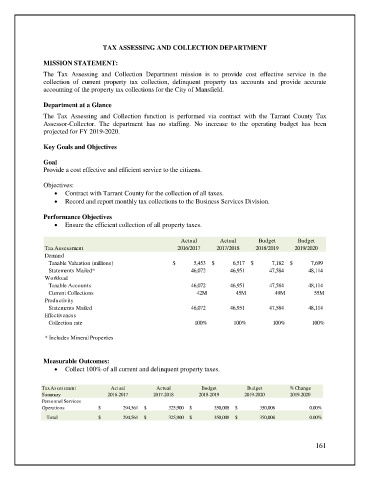

Actual Actual Budget Budget

Tax Assessment 2016/2017 2017/2018 2018/2019 2019/2020

Demand

Taxable Valuation (millions) $ 5,453 $ 6,517 $ 7,182 $ 7,699

Statements Mailed* 46,072 46,951 47,584 48,114

Workload

Taxable Accounts 46,072 46,951 47,584 48,114

Current Collections 42M 45M 49M 55M

Productivity

Statements Mailed 46,072 46,951 47,584 48,114

Effectiveness

Collection rate 100% 100% 100% 100%

* Includes Mineral Properties

Measurable Outcomes:

• Collect 100% of all current and delinquent property taxes.

Tax Assessment Actual Actual Budget Budget % Change

Summary 2016-2017 2017-2018 2018-2019 2019-2020 2019-2020

Personnel Services

Operations $ 294,561 $ 325,900 $ 350,008 $ 350,008 0.00%

Total $ 294,561 $ 325,900 $ 350,008 $ 350,008 0.00%

161