Page 222 - Microsoft Word - FY 2020 Adopted Budget Document

P. 222

Debt Service Fund

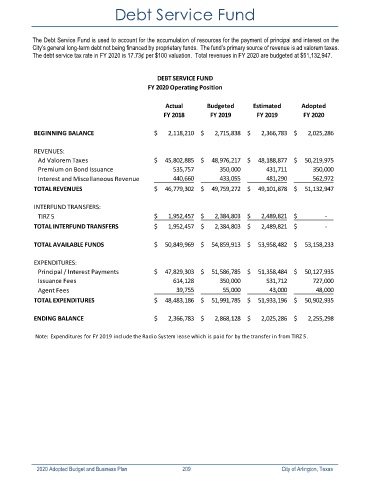

The Debt Service Fund is used to account for the accumulation of resources for the payment of principal and interest on the

City’s general long-term debt not being financed by proprietary funds. The fund’s primary source of revenue is ad valorem taxes.

The debt service tax rate in FY 2020 is 17.73¢ per $100 valuation. Total revenues in FY 2020 are budgeted at $51,132,947.

DEBT SERVICE FUND

FY 2020 Operating Position

Actual Budgeted Estimated Adopted

FY 2018 FY 2019 FY 2019 FY 2020

BEGINNING BALANCE $ 2,118,210 $ 2,715,838 $ 2,366,783 $ 2,025,286

REVENUES:

Ad Valorem Taxes $ 45,802,885 $ 48,976,217 $ 48,188,877 $ 50,219,975

Premium on Bond Issuance 535,757 350,000 431,711 350,000

Interest and Miscellaneous Revenue 440,660 433,055 481,290 562,972

TOTAL REVENUES $ 46,779,302 $ 49,759,272 $ 49,101,878 $ 51,132,947

INTERFUND TRANSFERS:

TIRZ 5 $ 1,952,457 $ 2,384,803 $ 2,489,821 $ ‐

TOTAL INTERFUND TRANSFERS $ 1,952,457 $ 2,384,803 $ 2,489,821 $ ‐

TOTAL AVAILABLE FUNDS $ 50,849,969 $ 54,859,913 $ 53,958,482 $ 53,158,233

EXPENDITURES:

Principal / Interest Payments $ 47,829,303 $ 51,586,785 $ 51,358,484 $ 50,127,935

Issuance Fees 614,128 350,000 531,712 727,000

Agent Fees 39,755 55,000 43,000 48,000

TOTAL EXPENDITURES $ 48,483,186 $ 51,991,785 $ 51,933,196 $ 50,902,935

ENDING BALANCE $ 2,366,783 $ 2,868,128 $ 2,025,286 $ 2,255,298

Note: Expenditures for FY 2019 include the Radio System lease which is paid for by the transfer in from TIRZ 5.

2020 Adopted Budget and Business Plan 209 City of Arlington, Texas