Page 223 - Microsoft Word - FY 2020 Adopted Budget Document

P. 223

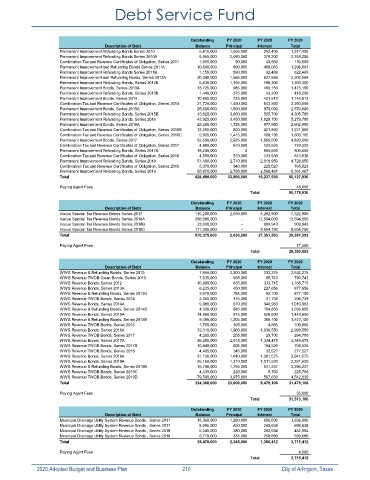

Debt Service Fund

Outstanding FY 2020 FY 2020 FY 2020

Description of Debt Balance Principal Interest Total

Permanent Improvement Refunding Bonds Series 2010 5,815,000 1,065,000 252,406 1,317,406

Permanent Improvement Refunding Bonds Series 2010A 6,955,000 2,080,000 278,200 2,358,200

Combination Tax and Revenue Certificates of Obligation, Series 2011 1,065,000 90,000 40,669 130,669

Permanent Improvement and Refunding Bonds Series 2011A 10,680,000 890,000 406,063 1,296,063

Permanent Improvement Refunding Bonds Series 2011B 1,155,000 590,000 32,469 622,469

Permanent Improvement and Refunding Bonds, Series 2012A 20,340,000 1,565,000 637,569 2,202,569

Permanent Improvement Refunding Bonds, Series 2012B 5,830,000 1,195,000 198,300 1,393,300

Permanent Improvement Bonds, Series 2013A 13,725,000 985,000 490,150 1,475,150

Permanent Improvement Refunding Bonds, Series 2013B 1,440,000 375,000 43,200 418,200

Permanent Improvement Bonds, Series 2014 10,865,000 725,000 421,913 1,146,913

Combination Tax and Revenue Certificates of Obligation, Series 2014 21,720,000 1,450,000 843,550 2,293,550

Permanent Improvement Bonds, Series 2015A 25,600,000 1,600,000 970,000 2,570,000

Permanent Improvement Refunding Bonds, Series 2015B 13,620,000 3,800,000 505,700 4,305,700

Permanent Improvement Refunding Bonds, Series 2016 43,925,000 3,450,000 1,829,700 5,279,700

Permanent Improvement Bonds, Series 2016A 29,265,000 1,725,000 877,950 2,602,950

Combination Tax and Revenue Certificates of Obligation, Series 2016B 13,595,000 800,000 421,850 1,221,850

Combination Tax and Revenue Certificates of Obligation, Series 2016C 9,905,000 1,415,000 188,195 1,603,195

Permanent Improvement Bonds, Series 2017 52,590,000 2,925,000 1,895,500 4,820,500

Combination Tax and Revenue Certificates of Obligation, Series 2017 4,880,000 610,000 123,525 733,525

Permanent Improvement Refunding Bonds, Series 2017A 18,240,000 0 806,650 806,650

Combination Tax and Revenue Certificates of Obligation, Series 2018 4,550,000 510,000 133,938 643,938

Permanent Improvement Refunding Bonds, Series 2018 51,490,000 2,710,000 2,018,950 4,728,950

Combination Tax and Revenue Certificates of Obligation, Series 2019 5,370,000 540,000 225,023 765,023

Permanent Improvement Refunding Bonds, Series 2019 55,870,000 2,795,000 2,596,467 5,391,467

Total 428,490,000 33,890,000 16,237,936 50,127,936

Paying Agent Fees 48,000

Total 50,175,936

Outstanding FY 2020 FY 2020 FY 2020

Description of Debt Balance Principal Interest Total

Venue Special Tax Revenue Bonds Series 2017 110,200,000 2,030,000 5,292,900 7,322,900

Venue Special Tax Revenue Bonds Series 2018A 266,080,000 - 12,594,000 12,594,000

Venue Special Tax Revenue Bonds Series 2018B 23,000,000 - 909,943 909,943

Venue Special Tax Revenue Bonds Series 2018C 171,095,000 - 8,554,750 8,554,750

Total 570,375,000 2,030,000 27,351,593 29,381,593

Paying Agent Fees 17,460

Total 29,399,053

Outstanding FY 2020 FY 2020 FY 2020

Description of Debt Balance Principal Interest Total

WWS Revenue & Refunding Bonds, Series 2010 7,950,000 2,300,000 332,275 2,632,275

WWS Revenue TWDB Clean Bonds, Series 2010 7,635,000 695,000 95,743 790,743

WWS Revenue Bonds, Series 2012 10,800,000 835,000 333,715 1,168,715

WWS Revenue Bonds, Series 2013A 6,235,000 450,000 227,656 677,656

WWS Revenue & Refunding Bonds, Series 2013B 3,070,000 785,000 92,100 877,100

WWS Revenue TWDB Bonds, Series 2014 2,555,000 175,000 31,739 206,739

WWS Revenue Bonds, Series 2014A 9,980,000 670,000 340,963 1,010,963

WWS Revenue & Refunding Bonds, Series 2014B 4,300,000 885,000 154,850 1,039,850

WWS Revenue Bonds, Series 2015A 14,580,000 915,000 528,600 1,443,600

WWS Revenue & Refunding Bonds, Series 2015B 9,490,000 1,205,000 368,100 1,573,100

WWS Revenue TWDB Bonds, Series 2016 1,765,000 105,000 4,866 109,866

WWS Revenue Bonds, Series 2016A 33,310,000 1,960,000 1,038,550 2,998,550

WWS Revenue TWDB Bonds, Series 2017 4,265,000 255,000 29,700 284,700

WWS Revenue Bonds, Series 2017A 36,255,000 2,015,000 1,334,475 3,349,475

WWS Revenue TWDB Bonds, Series 2017B 10,840,000 605,000 104,526 709,526

WWS Revenue TWDB Bonds, Series 2018 4,405,000 245,000 32,527 277,527

WWS Revenue Bonds, Series 2018A 31,100,000 1,640,000 1,301,575 2,941,575

WWS Revenue Bonds, Series 2019A 26,150,000 1,310,000 1,011,520 2,321,520

WWS Revenue & Refunding Bonds, Series 2019B 15,740,000 1,755,000 541,237 2,296,237

WWS Revenue TWDB Bonds, Series 2019C 4,435,000 220,000 5,760 225,760

WWS Revenue TWDB Bonds, Series 2019D 79,500,000 3,975,000 567,630 4,542,630

Total 324,360,000 23,000,000 8,478,106 31,478,106

Paying Agent Fees 35,000

Total 31,513,106

Outstanding FY 2020 FY 2020 FY 2020

Description of Debt Balance Principal Interest Total

Municipal Drainage Utility System Revenue Bonds , Series 2011 15,360,000 1,280,000 656,000 1,936,000

Municipal Drainage Utility System Revenue Bonds , Series 2017 8,095,000 450,000 249,638 699,638

Municipal Drainage Utility System Revenue Bonds , Series 2018 5,245,000 280,000 202,094 482,094

Municipal Drainage Utility System Revenue Bonds , Series 2019 6,770,000 335,000 258,680 593,680

Total 35,470,000 2,345,000 1,366,412 3,711,412

Paying Agent Fees 4,000

Total 3,715,412

2020 Adopted Budget and Business Plan 210 City of Arlington, Texas