Page 41 - Haltom City FY19 Annual Budget

P. 41

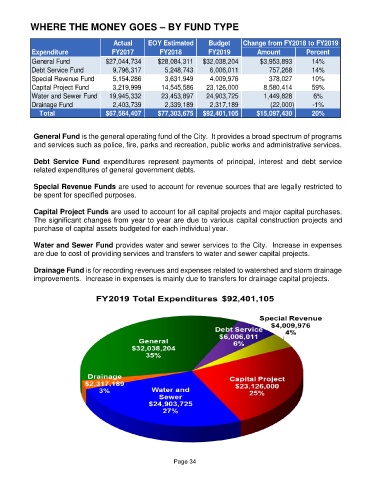

WHERE THE MONEY GOES – BY FUND TYPE

Actual EOY Estimated Budget Change from FY2018 to FY2019

Expenditure FY2017 FY2018 FY2019 Amount Percent

General Fund $27,044,734 $28,084,311 $32,038,204 $3,953,893 14%

Debt Service Fund 9,796,317 5,248,743 6,006,011 757,268 14%

Special Revenue Fund 5,154,286 3,631,949 4,009,976 378,027 10%

Capital Project Fund 3,219,999 14,545,586 23,126,000 8,580,414 59%

Water and Sewer Fund 19,945,332 23,453,897 24,903,725 1,449,828 6%

Drainage Fund 2,403,739 2,339,189 2,317,189 (22,000) -1%

Total $67,564,407 $77,303,675 $92,401,105 $15,097,430 20%

General Fund is the general operating fund of the City. It provides a broad spectrum of programs

and services such as police, fire, parks and recreation, public works and administrative services.

Debt Service Fund expenditures represent payments of principal, interest and debt service

related expenditures of general government debts.

Special Revenue Funds are used to account for revenue sources that are legally restricted to

be spent for specified purposes.

Capital Project Funds are used to account for all capital projects and major capital purchases.

The significant changes from year to year are due to various capital construction projects and

purchase of capital assets budgeted for each individual year.

Water and Sewer Fund provides water and sewer services to the City. Increase in expenses

are due to cost of providing services and transfers to water and sewer capital projects.

Drainage Fund is for recording revenues and expenses related to watershed and storm drainage

improvements. Increase in expenses is mainly due to transfers for drainage capital projects.

Page 34