Page 38 - Haltom City FY19 Annual Budget

P. 38

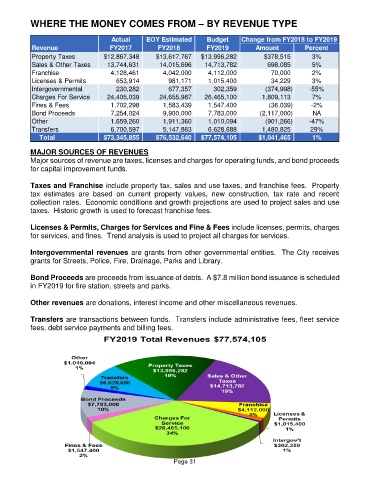

WHERE THE MONEY COMES FROM – BY REVENUE TYPE

Actual EOY Estimated Budget Change from FY2018 to FY2019

Revenue FY2017 FY2018 FY2019 Amount Percent

Property Taxes $12,867,348 $13,617,767 $13,996,282 $378,515 3%

Sales & Other Taxes 13,744,631 14,015,696 14,713,782 698,085 5%

Franchise 4,128,461 4,042,000 4,112,000 70,000 2%

Licenses & Permits 653,914 981,171 1,015,400 34,229 3%

Intergovernmental 230,282 677,357 302,359 (374,998) -55%

Charges For Service 24,405,039 24,655,987 26,465,100 1,809,113 7%

Fines & Fees 1,702,298 1,583,439 1,547,400 (36,039) -2%

Bond Proceeds 7,254,024 9,900,000 7,783,000 (2,117,000) NA

Other 1,659,260 1,911,360 1,010,094 (901,266) -47%

Transfers 6,700,597 5,147,863 6,628,688 1,480,825 29%

Total $73,345,855 $76,532,640 $77,574,105 $1,041,465 1%

MAJOR SOURCES OF REVENUES

Major sources of revenue are taxes, licenses and charges for operating funds, and bond proceeds

for capital improvement funds.

Taxes and Franchise include property tax, sales and use taxes, and franchise fees. Property

tax estimates are based on current property values, new construction, tax rate and recent

collection rates. Economic conditions and growth projections are used to project sales and use

taxes. Historic growth is used to forecast franchise fees.

Licenses & Permits, Charges for Services and Fine & Fees include licenses, permits, charges

for services, and fines. Trend analysis is used to project all charges for services.

Intergovernmental revenues are grants from other governmental entities. The City receives

grants for Streets, Police, Fire, Drainage, Parks and Library.

Bond Proceeds are proceeds from issuance of debts. A $7.8 million bond issuance is scheduled

in FY2019 for fire station, streets and parks.

Other revenues are donations, interest income and other miscellaneous revenues.

Transfers are transactions between funds. Transfers include administrative fees, fleet service

fees, debt service payments and billing fees.

Page 31