Page 33 - Haltom City FY19 Annual Budget

P. 33

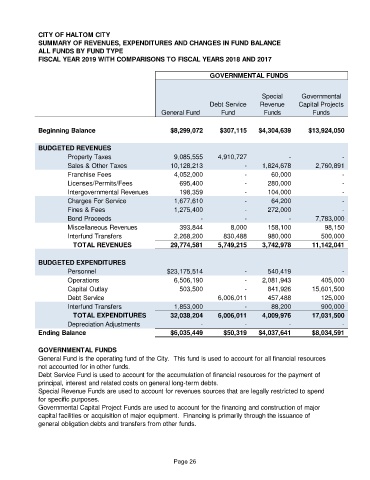

CITY OF HALTOM CITY

SUMMARY OF REVENUES, EXPENDITURES AND CHANGES IN FUND BALANCE

ALL FUNDS BY FUND TYPE

FISCAL YEAR 2019 WITH COMPARISONS TO FISCAL YEARS 2018 AND 2017

GOVERNMENTAL FUNDS

Special Governmental

Debt Service Revenue Capital Projects

General Fund Fund Funds Funds

Beginning Balance $8,299,072 $307,115 $4,304,639 $13,924,050

BUDGETED REVENUES

Property Taxes 9,085,555 4,910,727 - -

Sales & Other Taxes 10,128,213 - 1,824,678 2,760,891

Franchise Fees 4,052,000 - 60,000 -

Licenses/Permits/Fees 695,400 - 280,000 -

Intergovernmental Revenues 198,359 - 104,000 -

Charges For Service 1,677,610 - 64,200 -

Fines & Fees 1,275,400 - 272,000 -

Bond Proceeds - - - 7,783,000

Miscellaneous Revenues 393,844 8,000 158,100 98,150

Interfund Transfers 2,268,200 830,488 980,000 500,000

TOTAL REVENUES 29,774,581 5,749,215 3,742,978 11,142,041

BUDGETED EXPENDITURES

Personnel $23,175,514 - 540,419 -

Operations 6,506,190 - 2,081,943 405,000

Capital Outlay 503,500 - 841,926 15,601,500

Debt Service 6,006,011 457,488 125,000

Interfund Transfers 1,853,000 - 88,200 900,000

TOTAL EXPENDITURES 32,038,204 6,006,011 4,009,976 17,031,500

Depreciation Adjustments - - - -

Ending Balance $6,035,449 $50,319 $4,037,641 $8,034,591

GOVERNMENTAL FUNDS

General Fund is the operating fund of the City. This fund is used to account for all financial resources

not accounted for in other funds.

Debt Service Fund is used to account for the accumulation of financial resources for the payment of

principal, interest and related costs on general long-term debts.

Special Revenue Funds are used to account for revenues sources that are legally restricted to spend

for specific purposes.

Governmental Capital Project Funds are used to account for the financing and construction of major

capital facilities or acquisition of major equipment. Financing is primarily through the issuance of

general obligation debts and transfers from other funds.

Page 26