Page 46 - Fort Worth City Budget 2019

P. 46

Budget Highlights

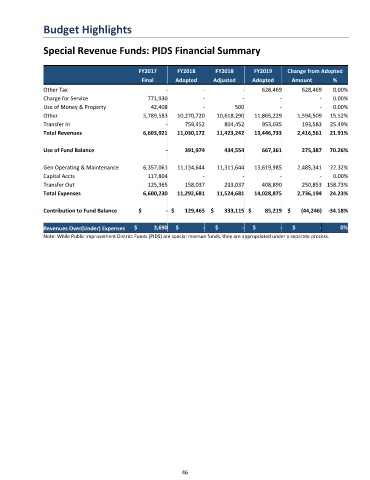

Special Revenue Funds: PIDS Financial Summary

FY2017 FY2018 FY2018 FY2019 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Other Tax - - - 628,469 628,469 0.00%

Charge for Service 771,930 - - - - 0.00%

Use of Money & Property 42,408 - 500 - - 0.00%

Other 5,789,583 10,270,720 10,618,290 11,865,229 1,594,509 15.52%

Transfer In - 759,452 804,452 953,035 193,583 25.49%

Total Revenues 6,603,921 11,030,172 11,423,242 13,446,733 2,416,561 21.91%

Use of Fund Balance - 391,974 434,554 667,361 275,387 70.26%

Gen Operating & Maintenance 6,357,061 11,134,644 11,311,644 13,619,985 2,485,341 22.32%

Capital Accts 117,804 - - - - 0.00%

Transfer Out 125,365 158,037 213,037 408,890 250,853 158.73%

Total Expenses 6,600,230 11,292,681 11,524,681 14,028,875 2,736,194 24.23%

Contribution to Fund Balance $ - $ 129,465 $ 333,115 $ 85,219 $ (44,246) -34.18%

Revenues Over(Under) Expenses $ 3,690 $ - $ - $ - $ - 0%

Note: While Public Improvement District Funds (PIDS) are special revenue funds, they are appropriated under a separate process.

46