Page 23 - BudgetBookCover_FY26_Adopted.pdf

P. 23

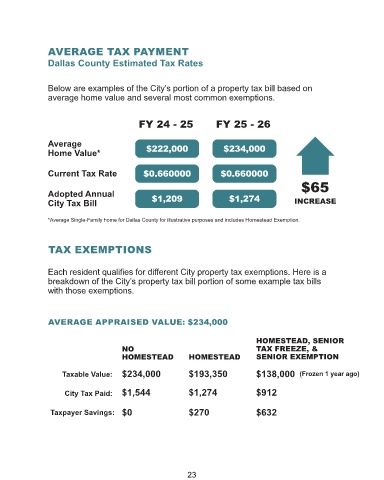

AVERAGE TAX PAYMENT

Dallas County Estimated Tax Rates

Below are examples of the City’s portion of a property tax bill based on

average home value and several most common exemptions.

FY 24 - 25 FY 25 - 26

Average

Home Value* $222,000 $234,000

Current Tax Rate $0.660000 $0.660000

$65

Adopted Annual

City Tax Bill $1,209 $1,274 INCREASE

*Average Single-Family home for Dallas County for illustrative purposes and includes Homestead Exemption.

TAX EXEMPTIONS

Each resident qualifies for different City property tax exemptions. Here is a

breakdown of the City’s property tax bill portion of some example tax bills

with those exemptions.

AVERAGE APPRAISED VALUE: $234,000

HOMESTEAD, SENIOR

NO TAX FREEZE, &

HOMESTEAD HOMESTEAD SENIOR EXEMPTION

Taxable Value: $234,000 $193,350 $138,000 (Frozen 1 year ago)

City Tax Paid: $1,544 $1,274 $912

Taxpayer Savings: $0 $270 $632

23