Page 21 - BudgetBookCover_FY26_Adopted.pdf

P. 21

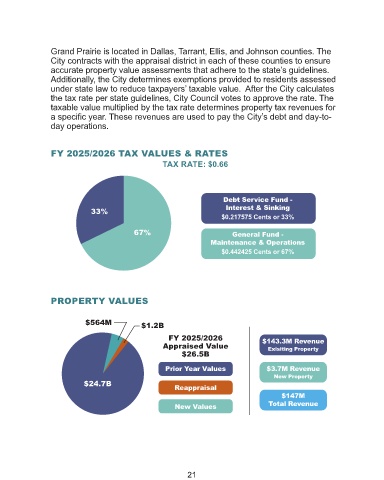

Grand Prairie is located in Dallas, Tarrant, Ellis, and Johnson counties. The

City contracts with the appraisal district in each of these counties to ensure

accurate property value assessments that adhere to the state’s guidelines.

Additionally, the City determines exemptions provided to residents assessed

under state law to reduce taxpayers’ taxable value. After the City calculates

the tax rate per state guidelines, City Council votes to approve the rate. The

taxable value multiplied by the tax rate determines property tax revenues for

a specific year. These revenues are used to pay the City’s debt and day-to-

day operations.

FY 2025/2026 TAX VALUES & RATES

TAX RATE: $0.66

Debt Service Fund -

33% Interest & Sinking

$0.217575 Cents or 33%

67% General Fund -

Maintenance & Operations

$0.442425 Cents or 67%

PROPERTY VALUES

$564M $1.2B

FY 2025/2026 $143.3M Revenue

Appraised Value Exisiting Property

$26.5B

Prior Year Values $3.7M Revenue

New Property

$24.7B

Reappraisal

$147M

New Values Total Revenue

21