Page 22 - BudgetBookCover_FY26_Adopted.pdf

P. 22

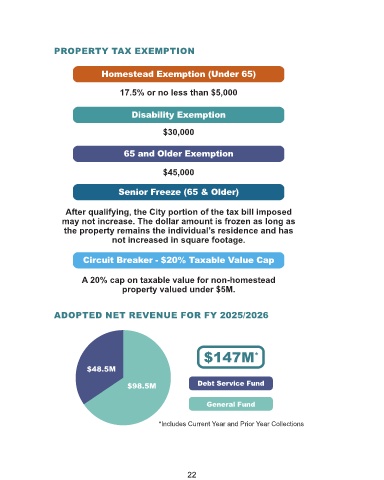

PROPERTY TAX EXEMPTION

Homestead Exemption (Under 65)

17.5% or no less than $5,000

Disability Exemption

$30,000

65 and Older Exemption

$45,000

Senior Freeze (65 & Older)

After qualifying, the City portion of the tax bill imposed

may not increase. The dollar amount is frozen as long as

the property remains the individual’s residence and has

not increased in square footage.

Circuit Breaker - $20% Taxable Value Cap

A 20% cap on taxable value for non-homestead

property valued under $5M.

ADOPTED NET REVENUE FOR FY 2025/2026

$147M *

$48.5M

$98.5M Debt Service Fund

General Fund

General Fund

*Includes Current Year and Prior Year Collections

22