Page 25 - BudgetBookCover_FY26_Adopted.pdf

P. 25

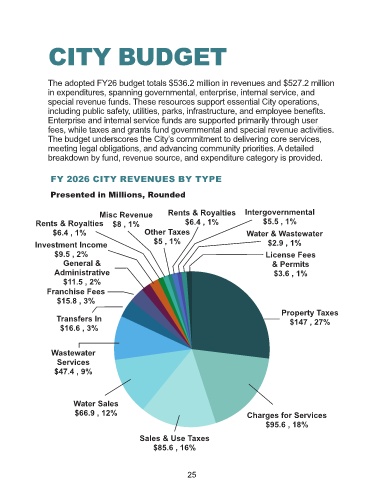

CITY BUDGET

The adopted FY26 budget totals $536.2 million in revenues and $527.2 million

in expenditures, spanning governmental, enterprise, internal service, and

special revenue funds. These resources support essential City operations,

including public safety, utilities, parks, infrastructure, and employee benefits.

Enterprise and internal service funds are supported primarily through user

fees, while taxes and grants fund governmental and special revenue activities.

The budget underscores the City’s commitment to delivering core services,

meeting legal obligations, and advancing community priorities. A detailed

breakdown by fund, revenue source, and expenditure category is provided.

FY 2026 CITY REVENUES BY TYPE

Presented in Millions, Rounded

Misc Revenue Rents & Royalties Intergovernmental

Rents & Royalties $8 , 1% $6.4 , 1% $5.5 , 1%

$6.4 , 1% Other Taxes Water & Wastewater

Investment Income $5 , 1% $2.9 , 1%

$9.5 , 2% License Fees

General & & Permits

Administrative $3.6 , 1%

$11.5 , 2%

Franchise Fees

$15.8 , 3%

Property Taxes

Transfers In $147 , 27%

$16.6 , 3%

Wastewater

Services

$47.4 , 9%

Water Sales

$66.9 , 12% Charges for Services

$95.6 , 18%

Sales & Use Taxes

$85.6 , 16%

25